If you received an email about the 1099-C Form, you can feel so confused. Even when you are unsure what it means for your taxes. Nearly 4 million taxpayers receive this confusing document each year, and face many unexpected tax bills because they don’t know what it means or how to respond. This form is also called the “cancellation debt form of 1099-C”, which affects your taxes.

In this comprehensive guide, we will cover everything you need to know about the 1099-C Form, including its instructions and key details.

What is IRS Form 1099-C

Form 1099-C referred to as the “Cancellation of Debt”, is a tax form the IRS uses to report cancelled or forgiven debt. In simple way of understanding is that if a bank, credit card company, or other lender forgives or cancels a debt you owed, the amount forgiven is usually considered taxable income by the IRS. The lender sends you a 1099-C Form to let you know how much debt was cancelled so you can report it on your tax return. Creditors are required to issue this form when they forgive, cancel, or discharge $600 or more of a debt.

According to Ronald Shields Cook, this form is generally considered taxable income, which may increase your tax liability unless an exclusion applies.

When You Get It?

- If your credit card company writes off an unpaid balance

- If student loans are discharged

- Vehicle repossession with remaining balance forgiven

- Medical debt

- Foreclosure or short sale on your home

The result: The canceled amount is generally considered ordinary income, which means you may owe taxes on it, unless an exception applies.

Important: According to IRS Topic no. 432, A creditor must issue Form 1099-C when a debt is canceled, but receiving the form doesn’t automatically mean the amount is taxable. You must review whether an exclusion applies, such as insolvency or bankruptcy, and, if so, file Form 982 to report it.

Who Must File IRS Form 1099-C

Creditors, lenders, financial institutions, or anyone in the business of lending money must file Form 1099-C if an “identifiable event” cancels $600 or more of debt.

When to file and important Deadlines

- Banks and Credit Unions – If they cancel $600 or more of debt you owe.

- Credit Card Companies – When they forgive part or all of your outstanding balance.

- Mortgage Lenders – If they cancel a portion of your mortgage debt.

- Retailers or Finance Companies – For forgiven store or personal loans.

- Government Agencies – When they cancel certain student loans or other federal debts.

- Other Lenders – Any organization that cancels $600 or more in debt owed to them.

The official deadlines for Form 1099-C:

| Action | Deadline |

| Give Copy B to the recipient | February 2, 2026 |

| File Copy A with the IRS (paper) | March 2, 2026 |

| File Copy A with the IRS (electronic) | March 31, 2026 |

Tip: IRS may update filing requirements so always confirm deadlines for the current tax year.

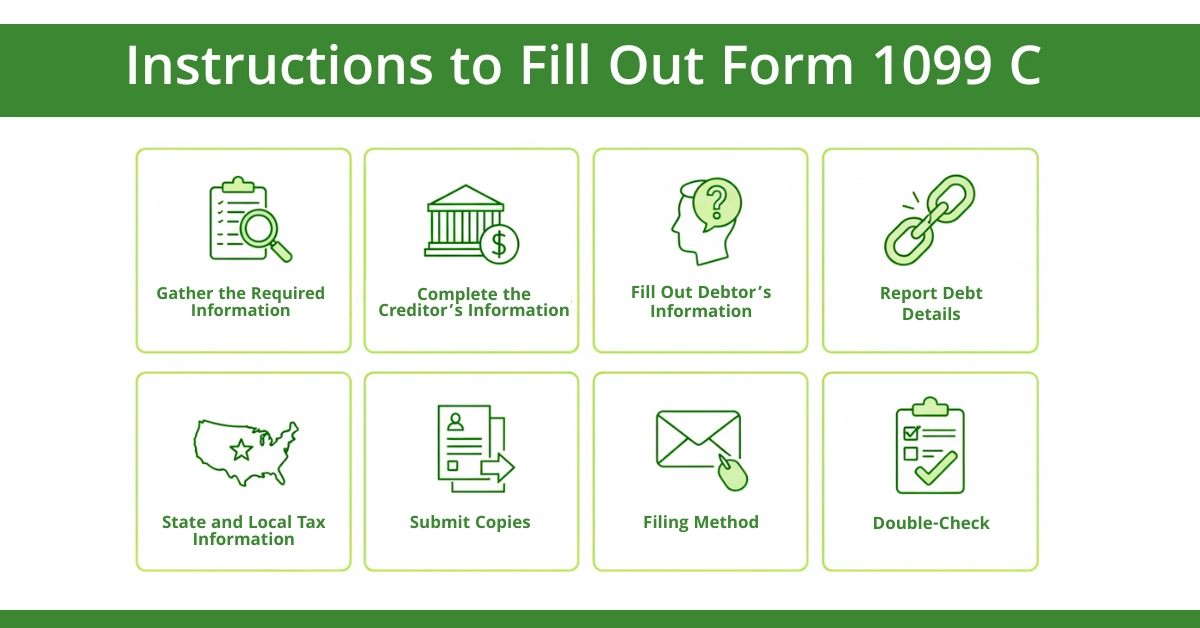

Step-by-Step Instructions to Fill Out Form 1099 C:

If you’re the creditor responsible for issuing Form 1099 C, here’s how to complete each box:

Step 1: Gather the Required Information

- Debtor’s details: Name, address, and Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Creditor’s details: Name, address, and TIN (EIN if a business).

- Debt information: Amount canceled, date of cancellation, and account number (if applicable).

Left Side of Form:

- Creditor’s Name, Address, and TIN: Include complete business information and employer identification number (EIN). The creditor’s TIN cannot be truncated.

- Debtor’s TIN: Enter the debtor’s Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or EIN. For privacy, this may be truncated on the debtor’s copy.

Step 2: Complete the Creditor’s Information (Payer)

- Box 1: Enter the creditor’s name, address, and TIN.

- Box 2: Check the appropriate box for the type of debt (e.g., credit card, mortgage, other).

Step 3: Fill Out Debtor’s Information (Recipient)

- Box 3: Enter the debtor’s name, address, and SSN/TIN.

- Box 4: Optional—include an account number for the canceled debt.

Step 4: Report Debt Details

- Box 2 (Amount of Debt Discharged): Enter the exact amount of debt canceled.

- Box 5 (Debt Description): Optional description of the canceled debt (e.g., personal loan, credit card).

- Box 6 (Interest): Enter any interest included in the canceled debt.

- Box 7 (Check if identifiable event applies): Check if the cancellation falls under bankruptcy, foreclosure, or other situations.

Step 5: State and Local Tax Information

-

Fill out boxes 8–10 if state or local tax reporting is required.

Step 6: Submit Copies

- Copy A: Send to the IRS (usually via paper or electronic filing).

- Copy B: Give to the debtor/recipient by January 31.

- Copy C: Keep for your records.

Step 7: Filing Method

- Paper Filing: Use red-ink forms for Copy A if submitting by mail.

- Electronic Filing: Required if filing 250+ forms. Use the IRS FIRE system.

Step 8: Double-Check

-

Verify all amounts, names, and TINs. Errors can trigger IRS notices.

Tip from Acct. Right, PLLC: For businesses and financial professionals managing IRS reporting, understanding other 1099 forms can be just as important. Our Form 1099‑NEC Instructions guide provides clear steps for filing nonemployee compensation, complementing your 1099‑C filing process.

What to Do If You Receive a 1099 C For Debtors

Getting a 1099 C can feel like bad news, but you have options and responsibilities.

Carefully review the form, check that the amount, date, and cancellation event listed are accurate. Mistakes or debt sale situations (rather than true forgiveness) can happen, according to the Taxpayer Advocate Service

- Treat the cancelled debt as income: Unless an exclusion applies, the amount in Box 2 generally becomes taxable income.

- Check accuracy: If you believe the amount, date, or other details are wrong or the debt was canceled due to fraud or identity theft, contact the creditor to request correction. As per IRS guidelines, 1099-C should not be used for fraudulent/identity theft debts.

- Look for exceptions/exclusions.

For example:

Debts discharged in bankruptcy (subject to certain rules) may be excluded.

Insolvency at the time of discharge can also make part or all of the forgiven debt non-taxable (using Form 982). - Consult a tax professional, especially if you have multiple debts canceled, are insolvent, or have received multiple 1099 C forms. This is where a firm like Acct. Right, PLLC can help simplify tax filings for individuals or businesses.

How to Report 1099-C on Your Tax Return

For Individuals (Form 1040)

- Determine if you qualify for an exclusion (insolvency, bankruptcy, etc.)

- If taxable: Report on Schedule 1, Line 8z (“Other income: Cancellation of debt”)

- If excluding: File Form 982 with your return

- Keep detailed records: Asset/liability statements showing insolvency

- Attach explanation: If insolvent, include a statement with your return

For Businesses

- C-Corporations (1120): Report as “Other income” on line 10

- S-Corporations (1120S): Report on line 5, flows to K-1

- Partnerships (1065): Report on line 7, flows to K-1

Receive a 1099-C for an Old Debt

You might receive a Form 1099-C for debt that was charged off years ago, which can happen when a lender finally writes it off their books.

Your Rights:

- The date in Box 1 determines the tax year

- The statute of limitations doesn’t prevent IRS collection on unreported income

- You can still claim exclusions if you qualify

- Document everything, old bank statements, asset records

Beware Double Reporting:

If you previously reported this as income (or it’s barred by insolvency), you only need to address it if the IRS contacts you. Keep your Form 982 from that year as proof.

Difference in 1099 C and 1099-A Form

These forms often arrive together but serve different purposes:

| Feature | Form 1099-A | Form 1099-C |

| Purpose | Acquisition/Abandonment of property | Cancellation of debt |

| When Issued | Property transferred | Debt officially forgiven |

| Taxable Event | Usually not taxable itself | Generally taxable (with exceptions) |

| Information | FMV, loan balance | Amount canceled, event code |

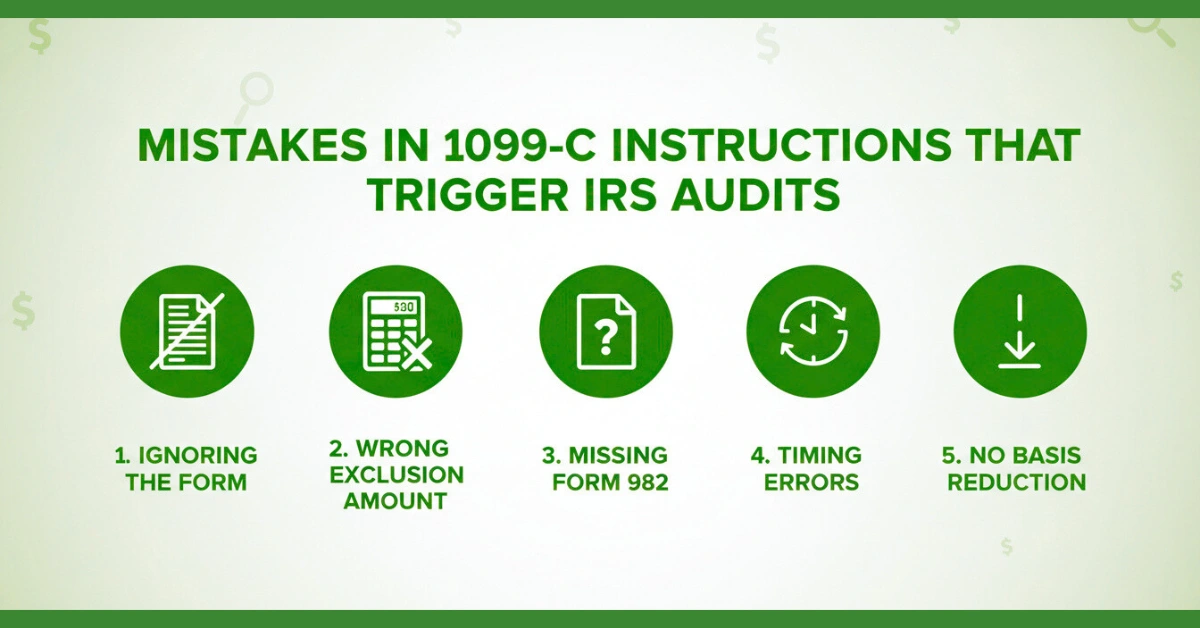

Mistakes in 1099 C Form Instructions That Trigger IRS Audits

Avoid these pitfalls that TurboTax and Investopedia frequently warn about:

- Ignoring the Form: The IRS receives a copy. Failure to report it guarantees a matching notice (CP2000).

- Wrong Exclusion Amount: Calculating insolvency incorrectly, must use the fair market value of assets, not the purchase price.

- Missing Form 982: You must file this form to claim exclusions; simply not reporting the income isn’t sufficient.

- Timing Errors: Using the wrong date for the identifiable event can shift income to the wrong tax year.

- No Basis Reduction: Some exclusions require reducing tax attributes (like basis in property), which affects future sales.

Business Owner Warning: If your S-corporation (1120S) or partnership (1065) receives a Form 1099-C, the tax treatment flows through to your personal return. Our Fractional CFO Services include planning for these events to minimize both business and personal tax impact.

Final Checklist

- Verify the form’s accuracy immediately upon receipt.

- Calculate your insolvency position using current asset values.

- Determine if you qualify for any exclusions.

- File Form 982 if claiming an exclusion (don’t forget!).

- Report the income correctly on your appropriate tax form.

- Keep detailed records for at least 4 years.

- Consult a tax professional for complex situations.

Disclaimer:

This information is shared to help you understand the topic, not to advise you personally. Tax laws vary and may update over time. Get professional help to ensure you file correctly. Some examples or visuals may be simplified or created for explanation purposes.

Frequently Asked Questions

Is Form 1099-C the same as 1099-MISC?

No. 1099-C reports canceled debt, while 1099-MISC reports miscellaneous income like contractor payments. They serve different IRS purposes.

What if I never received a 1099-C, but my debt was canceled?

You must still report canceled debt as income unless an exclusion applies, even if no form was received.

Can I dispute a 1099-C if I still owe the debt?

Yes. Contact the creditor immediately for correction if the debt wasn’t actually canceled or was sold.

Do I need to file Form 1099-C for debts under $600?

No. Filing is only required for canceled debts $600 or more, but taxable income rules still apply.

How long do I have to keep 1099-C records?

Keep all 1099-C forms and supporting documentation at least three years; longer if claiming exclusions like insolvency.

What’s the difference between recourse and non-recourse debt on 1099-C?

Recourse debt holds the borrower personally liable; non-recourse limits recovery to collateral. Box 5 indicates the type.