Form 843 is an important IRS form that is used to request certain tax abatements, refunds, adjustments, penalties, fees, or interest. Whether you are a business or an individual, knowing when and how to use this form can save you penalties and unnecessary costs.

You or your authorised representative may fill it. In case your authorised person is filling it out on your behalf, a copy or the original Form 2848 should be attached (with your signatures) – this is a declaration and power of attorney for your representative to act on your behalf.

Below is a detailed breakdown of Form 843 IRS usage, scenarios, prerequisites, and filing instructions.

What is Form 843?

Form 843 is used by taxpayers to request a refund of certain taxes, seek an abatement (removal) of interest, penalties, or additions to tax, and make claims for erroneous assessments. However, it does not apply to all types of taxes, as specific rules and limitations determine when this form can be used.

Who Can Use IRS Form 843?

Depending on the tax issue, both businesses and individuals can use it:

- Businesses: To request relief from penalties or interest related to payroll or excise taxes.

- Individuals: To claim refunds or abatements on personal penalties or interest charges.

Attention: Taxpayers with Visual impairments who were unable to read and respond to notices from the IRS in standard format may use it and use line 8 to add their explanation. Remember, your explanation should include:

- The nature of your disability is causing a hindrance in reading the standard notice from the IRS.

- Date of receiving the notice.

- Date you found what this standard printed notice said.

- If you requested the IRS for any alternate notice, specify its date too.

Note: Form 843 doesn’t directly address “reporting tips,” but it can be used to correct issues or request relief related to Social Security tips.

Common Scenarios for Using IRS Form 843

The following is to make it easier for you to fill IRS Form 843:

Penalty Abatement

- Scenario: A business faces late filing penalties due to a natural disaster.

- Documents Required: Proof of disaster or reasonable cause documentation.

- Pre-requisite: The IRS must have already assessed the penalty.

Interest Abatement

- Scenario: An individual is charged interest because of an IRS error.

- Documents Required: IRS correspondence showing the error.

- Pre-requisite: Must clearly prove that it was the IRS’s fault.

Erroneous Assessment

- Scenario: An employer overpaid employment tax.

- Documents Required: Payroll tax returns and proof of payments.

- Pre-requisite: IRS acknowledgement of the assessment.

Wrongful Levy

- Scenario: The IRS levied property by mistake.

- Documents Required: Evidence supporting wrongful levy.

- Pre-requisite: IRS levy notice must be available.

Overpaid Certain Excise Taxes

- Scenario: A taxpayer overpaid federal excise tax on fuel.

- Documents Required: Proof of payment.

- Pre-requisite: The payment must fall under eligible excise tax categories.

Scenarios Where Form 843 Cannot Be Used

It’s important to check IRS instructions before you submit your form. The following are some of the major scenarios where Form 843 should not be used.

- FICA tax corrections (use Form 941-X instead).

- RRTA (Railroad Retirement Tax Act) tax adjustments.

- Income tax withholding corrections (use the proper amended return).

Looking to offload such tasks?

Acct. Right, PLLC offers comprehensive accounting and taxation solutions. Tailored to meet your needs, we can design strategies to help you achieve your goals.

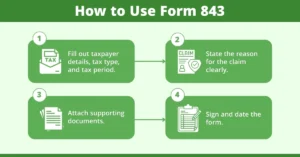

How to Use IRS Form 843: Step by Step

Here is how to use this abate relief form:

- Fill out the taxpayer details, tax type, and tax period.

- State the reason for the claim clearly.

- Attach supporting documents.

- Sign and date the form.

Caution: Filing when not applicable can delay processing and may cause loss of refund rights.

First Time Users: Please note that the first-time users or the ones who have a clear past 3-year record may call IRS as well. As a first-time abate relief user, you can request even if you have not paid your full tax.

Deadlines for Filing Form 843

- Generally, file within 3 years from the date the original return was filed, or

- 2 years from the date the tax was paid, whichever is later.

Where to Send Form 843

The 843 form mailing address depends on the reason for filing. Addresses may vary based on state and tax type:

- If related to an estate, excise, income, gift, employment, etc., send to the office address in the notice.

- A request for a net interest rate of zero should be sent to the service centre where you last submitted your returns.

When filing Form 843 in response to Letter 4658, whether you have tax matters, are claiming a refund, or are dealing with penalties, please proceed to this IRS page for complete 843 form mailing guidance.

Some Form 843 Scenarios

- Business: Acct Right PLLC filed payroll late due to a hurricane. They used IRS Form 843 penalty abatement citing reasonable cause, and attached FEMA disaster proof.

- Individual: An individual received interest charges due to an IRS miscalculation. They used IRS Form 843, reasonable cause with an IRS error notice attached.

Sample Filled-Out Examples

1. First Time Abatement:

- Box 5a: Check “Abatement of penalty.”

- Line 7: Write “Requesting first-time abatement for late filing – prior 3 years compliant.”

- Attach the compliance record.

2. Wrongful Levy Refund:

- Box 5d: Check “Refund of wrongful levy.”

- Line 7: Write “IRS levied funds in error on 2026. Request refund.”

- Attach IRS levy notice.

Final Thoughts

The IRS abatement form 843 is a powerful tool for both individuals and businesses to seek relief from unfair tax penalties or interest. Always consult instructions for IRS Form 843 carefully before filing. For tailored assistance, consider working with a tax professional like Acct Right PLLC to ensure your claim is properly supported and filed on time.

Disclaimer: This blog is for informational purposes only and does not constitute any legal or professional advice. While we strive for accuracy, errors or omissions may occur. Some images in this blog may be AI-generated or for illustrative purposes only.

Frequently Asked Questions

Can Form 843 be faxed to the IRS?

No. The instructions do not provide any option for faxing. The form must be mailed to the IRS to the address specified for your type of claim.

Can I file Form 843 online?

No. There is no provision in the document to file Form 843 online. It must be completed in paper form and mailed in.