If you have an IRA, you might be wondering, “What exactly is IRS Form 5498, and do I need to worry about it?” Here’s the deal: Form 5498 is sent by your bank, brokerage, or financial institution to let both you and the IRS know about your IRA contributions, rollovers, Roth conversions, and the fair market value (FMV) of your account.

Even though you don’t attach it to your tax return, it’s still very important. It acts like proof that your contributions are within IRS limits and that your account is being reported correctly. Miss it, or report it wrong, and you could face unnecessary headaches or even penalties.

By the end of this guide, you’ll know exactly know about who receives Form 5498, what contributions and conversions it reports, how it’s different from Form 1099-R, and how to stay fully compliant in 2025.

Why Form 5498 Matters

Form 5498 is an informational form that IRA custodians send to the IRS. It reports things like contributions, rollovers, and the account’s fair market value (FMV). Unlike taxable forms, it doesn’t create a tax bill for the account holder. Its main purpose is to confirm that IRA contributions stay within the annual limits and to help avoid penalties for overfunding. This form is different from Form 1099-R, which reports taxable withdrawals, because Form 5498 is only for reporting, not for taxes.

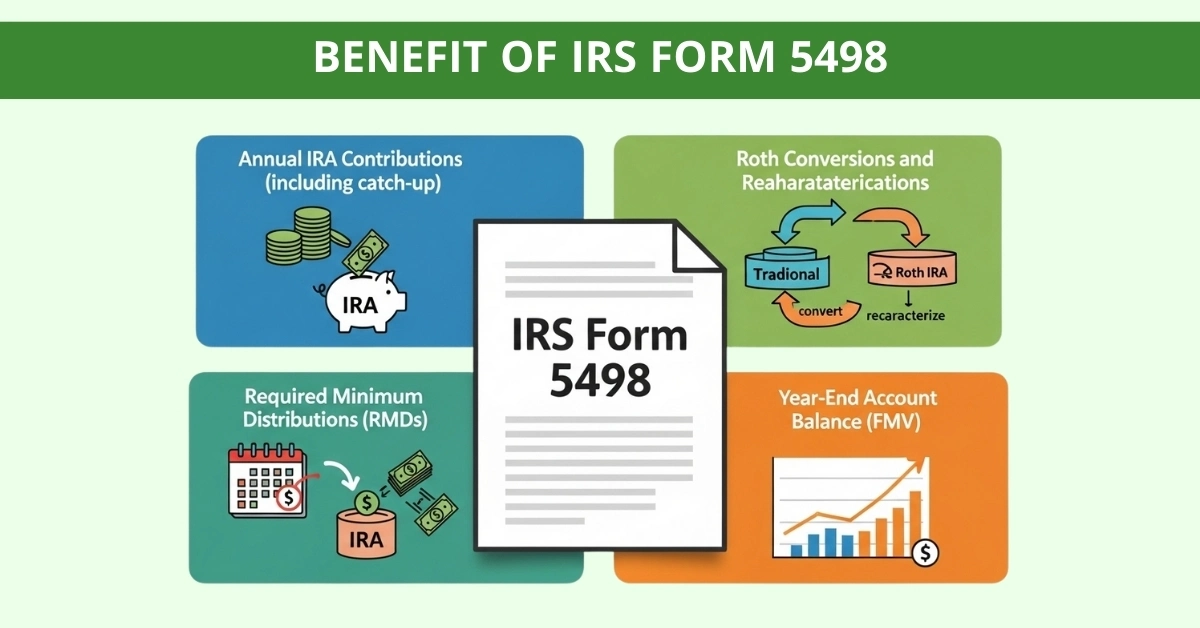

Benefits of IRS Form 5498

- It documents your annual IRA contributions, including catch-up contributions if you’re 50 or older. In 2025, you can contribute $7,000 if you’re under 50, or $8,000 if you’re 50+.

- It tracks Roth conversions and any recharacterisations you made.

- It reports RMDs if you’re 73 or older.

- It shows your year-end account balance (FMV) for accurate record-keeping.

Penalty range ($50-$310), this refers to custodians who file incorrect forms, not the taxpayer directly. Clarify its custodian penalties, not IRS penalties for the IRA owner.

Who Receives Form 5498

Form 5498 is sent by your bank or brokerage to you and the IRS if you made IRA contributions, did a Roth conversion, or need to report your account’s value. You’ll usually get it by June 1, 2026, for activity in 2025, though some providers post it earlier online. You can also download it from your provider’s portal or the IRS website. If you don’t receive it, contact your provider. Remember, you have until April 15, 2026, to make 2025 IRA contributions, and Form 5498 (filed by May 31, 2026) will show them. Keep this form for your records.

Types of IRAs Reported on Form 5498

Not all IRAs are the same, and Form 5498 applies to multiple retirement vehicles. Form 5498 is not issued for 401(k)s or non-IRA accounts. See the table below:

| IRA Type | Description | Key Reporting on Form 5498 |

| Traditional IRA | Deductible pre-tax savings. | IRA contributions, rollovers, FMV, RMDs. |

| Roth IRA | Post-tax growth. | Roth conversions, contributions, FMV. |

| SEP IRA | Employer-funded for small businesses. | SEP IRA Form 5498 employer contributions, FMV. |

| SIMPLE IRA | Employee deferrals with matches. | SIMPLE IRA Form 5498 amounts, FMV. |

| Inherited IRA | Post-death transfers. | FMV for beneficiary RMDs. |

This covers core IRA tax forms. Knowing your IRA type ensures your contributions and distributions are correctly reported according to IRS codes §408, §408A, §408(k), and §408(p).

Related Forms: Focus on Form 5498-SA

The Form 5498-SA is for HSAs, Archer MSAs, and Medicare Advantage MSAs. When you are dealing with the HSA (Health Savings Accounts), you must keep an eye on Form 5498-SA. The regular Form 5498 is all about IRAs. The Form 5498-SA shows your complete contribution for the year and also including rollovers and the amount you can deduct on your tax return (Form 1040).

Just like Form 5498, which deals with IRAs, your HSA provider will also send this form by June 1, 2026, if you had any tax in 2025. Always keep in mind that the HSA contribution limits are different. For example, the limits for 2025 people are $4,150. If you don’t understand the rules, take a complete look at Form 5498-SA instructions or ask a tax professional for guidance.

Contribution Reporting on Form 5498

Form 5498 contribution reporting lists totals in boxes per IRS guidelines.

Table of types and boxes (2025 IRS Form 5498 instructions):

| Contribution Type | Form 5498 Box | Notes |

| Traditional IRA contribution | Box 1 | Regular contribution |

| Roth IRA contribution | Box 10 | Regular contribution |

| Rollover (from another plan or IRA) | Box 2 | 60-day or trustee-to-trustee |

| Roth conversion | Box 3 | Traditional/SEP/SIMPLE → Roth |

| Recharacterization | Box 4 | Roth to Traditional switch |

| SEP contribution | Box 8 | Employer-funded |

| SIMPLE IRA contribution | Box 9 | Employer-funded |

| Prior-year Roth contributions (made Jan–Apr) | Box 11 | For the prior tax year only |

Cross-check with records; amend via IRS if needed.

Quick Example: If you contributed $7,000 to a Traditional IRA and converted $3,000 to a Roth IRA, Box 1 will show $7,000, and Box 4 will show $3,000.

Deadlines and IRS Requirements for Form 5498

IRS 5498 deadline: File with the IRS by May 31, 2026 (or the next business day if it falls on a weekend). Electronic filing is required if you file 10 or more information returns. Retain records for 3 years from the filing deadline.

Penalties escalate for delays. Use the IRS FIRE system for submissions.

Common Mistakes to Avoid in IRS Form 5498

Avoid:

- Missing IRS deadlines

- Inaccurate FMV

- Ignoring RMD requirements

- Unreported recharacterizations

- Confusing Form 5498 with Form 1099-R

- Ignoring SEP/SIMPLE IRA boxes

Review your Form 5498 annually with your custodian to catch errors early.

Tips for Accurate Reporting and Compliance

- Log every contribution, rollover, or conversion during the year.

- Ask your custodian for a draft of Form 5498 early.

- Check the year-end FMV against your statements.

- Document rollovers and recharacterizations.

- Calculate RMDs using IRS life expectancy tables.

- Consult a professional for an inherited IRA or complex situations.

How Acct. Right, PLLC Supports IRA Reporting

We make IRA reporting simple:

- Guides you through Form 5498 requirements

- Reconciles contributions, RMDs, and FMV

- Offers expertise for SEP, SIMPLE, and inherited IRAs

- Support with rollovers, conversions, and recharacterisations.

- Assurance that your reporting meets IRS rules.

Let us make your retirement reporting stress-free with just one click.

Conclusion:

IRS Form 5498 isn’t something you need to file yourself, but it’s definitely something you shouldn’t ignore. It is an official document that shows your IRA contributions, rollovers, and the year-end balance. It has been properly reported to the IRS. You think of it like a receipt for your retirement savings. If something is wrong, like missing the documents or a required minimum distribution (RMD) or reaching your contribution limit, it will cause problems for you. Keep your tax documents with you and ensure they match your own records. If you face any issues related to this, talk to your IRA custodian or a tax professional. For 2025, just staying on top of deadlines, contribution limits, and account balances will keep you on the safe side, and if you ever need help Acct. Right, PLLC has your back.

Frequently Asked Questions

What is IRS Form 5498?

IRS Form 5498 is an informational tax form showing your IRA contributions, rollovers, Roth conversions, and year-end fair market value.

Do I file Form 5498 with my tax return?

No. You don’t file it with your return. Your custodian sends it directly to the IRS, and you just keep it for your records.

Why is Form 5498 important?

It confirms your contributions are within IRS limits, tracks rollovers, and helps verify required minimum distributions (RMDs).

What’s the deadline for Form 5498 in 2025?

Custodians must send copies by June 1, 2026, but contribution reporting covers the 2025 tax year through April 15, 2026.

How is Form 5498 different from Form 1099-R?

Form 5498 reports contributions and account values. Form 1099-R reports taxable withdrawals and distributions.

Disclaimer:

This content is for informational purposes only and is not tax advice. Consult the Acct Right team, qualified professional, for guidance specific to your situation.

Some visuals in this blog may be illustrative or digitally created. All blog images are the property of their respective owners and are shown for reference only.