The 1098 T form is a school tax form. Colleges and universities send it each year. It reports tuition payments and scholarships or grants. You use it to see if you can claim the American Opportunity Tax Credit or the Lifetime Learning Credit on your federal tax return. The due date for educational institutions to submit this to the IRS is February 28, while a copy should be provided to the student or their guardian by January 31.

Please note that this 1098-T form is not to be filled out or submitted by the students or their guardians; instead, the educational institution fills it and sends it to both you and the IRS. You do not mail the form itself with your return. It is an information return you keep.

Form 1098-T: Who Receives It and Who Doesn’t

- Educational institutions must prepare a form for each enrolled student who had a reportable transaction for the calendar year.

(Here, Reportable Transactions are payments received for qualified tuition and related expenses or scholarships/grants processed). - You may not receive a form if: you only took non-credit courses; you are a nonresident alien (unless requested); your charges were fully covered by scholarships or grants; or your charges were paid under a formal billing arrangement with an employer or a government agency (for example, Veterans Affairs).

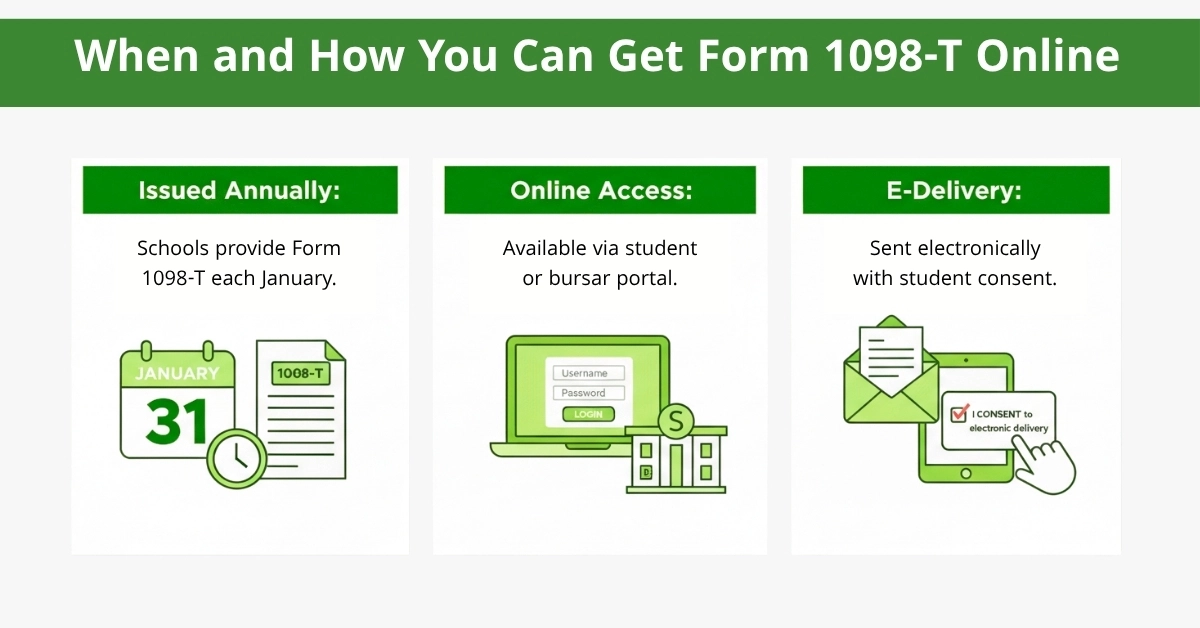

When and How You Can Get Form 1098-T Online

- Educational institutions furnish student copies each January for the prior year (during which the transactions were made).

- Most schools post it in the bursar or student portal, so you can get 1098 t online and download the PDF. Examples: University of Tennessee and University of Illinois explain online retrieval and what the boxes mean.

- Schools may deliver the form electronically if you consent and the school follows the IRS e-delivery rules.

Finding it difficult or laborious?

Outsource such tasks to a trusted Accounting and Taxation firm like Acct. Right, PLLC today, and enjoy or spend your time where it matters more

AOTC and LLC Requirements for IRS Form 1098-T

- American Opportunity Tax Credit: This credit can be worth up to 2,500 dollars per eligible student. The formula is: 100 percent of the first 2,000 dollars of qualified expenses plus 25 percent of the next 2,000 dollars. Up to 40 percent (maximum 1,000 dollars) can be refunded to you even if you owe no tax. You can claim this credit only for the first four years of post-secondary education, and you must be at least half-time for one academic period during the year.

- Lifetime Learning Credit: This credit can be worth up to 2,000 dollars per tax return. The formula is 20 percent of up to 10,000 dollars of qualified expenses. It is not refundable. It is available for undergraduate, graduate, and professional courses, including a single course to improve job skills. There is no limit on the number of years you can claim it.

- Both credits cannot be claimed for the same student in the same year.

For more detailed information on the Lifetime Learning Credit (LLC) and American Opportunity Tax Credit (AOTC), please visit the IRS.

Note: Understanding the details of IRS Form 1098-T is just one part of managing your yearly tax documents. If you’re also handling other forms like IRS Form 5498 for retirement contributions or Form 8949 for investment reporting, it’s essential to know how each affects your overall tax filing.

Filling IRS 1098-T Form Made Easy

Here is how each box guides your credit claim. Here is a simple version you can follow.

| Box | What you will see | Why it matters |

| 1 | Payments received for qualified tuition and related expenses in the calendar year | This is the starting number for computing education credits |

| 4 | Adjustments to prior-year qualified amounts | May change a prior year’s credit and could require a correction |

| 5 | Scholarships or grants processed by the school | Reduces the expenses you can use for credits |

| 6 | Adjustments to prior-year scholarships or grants | May change a prior year’s credit |

| 7 | Checkbox: a portion of Box 1 was for January–March of next year | Tells you that part of Box 1 is a prepayment for spring |

| 8 | Checkbox: at least half-time student | Needed for the American Opportunity Tax Credit |

| 9 | Checkbox: graduate student | Often points you to the Lifetime Learning Credit rules |

| 10 | Insurance reimbursements or refunds (used by insurers) | Rare for most students; reduces eligible expenses |

Conclusion

Form 1098 T is not to be filled by the students or their guardians; instead, it’s the educational institutions who are responsible for submitting it to the IRS and providing a copy to the students or their parents/guardians, where applicable, obviously. While this document is not related to taxation directly for the educational institutions, e.g., colleges or universities, Tax firms like Acct. Right, PLLC, on top of handling your Taxations and Accounting, can help with such administrative tasks as well.

Disclaimer: This blog is for informational purposes only and does not constitute medical, legal, or professional advice. While we strive for accuracy, errors or omissions may occur.

Some images in this blog may be AI-generated or for illustrative purposes only.