If you’re self-employed or run a small business in the U.S., the Qualified Business Income (QBI) deduction can lower your taxable income by up to 20% to professional financial experts. To claim it, you’ll need to file IRS Form 8995, a simplified form that helps ensure you get the deduction correctly and don’t miss out on potential savings

In this form 8995 instructions guide, our Acctrights experts are going to describe the real definition of Form 8995. Moreover, this guide will guide you on who is required to file it and how to fill it step-by-step to complete it during the 2025-26 tax year. No matter whether you are a freelancer, owner of LLC, or operator of a small business, this guide will be your helping book.

What Is IRS Form 8995 and Why Does It Matter

To claim the 20% deduction under Section 199A of the Internal Revenue Code, you use IRS Form 8995, officially called the Qualified Business Income Deduction Simplified Computation. This deduction lets eligible taxpayers reduce their taxable business income by more than 20%. The IRS form is especially helpful for those with income below the IRS threshold, as they don’t need to complete the more complicated Form 8995-A.

For 2025 to onward 2026, Form 8995 continues to be a crucial part of small business tax filing, especially for:

- Sole proprietors filing Schedule C

- Partners in a partnership

- S corporation shareholders

- Certain trusts and estates

Understanding this form ensures you’re not leaving potential deductions unclaimed.

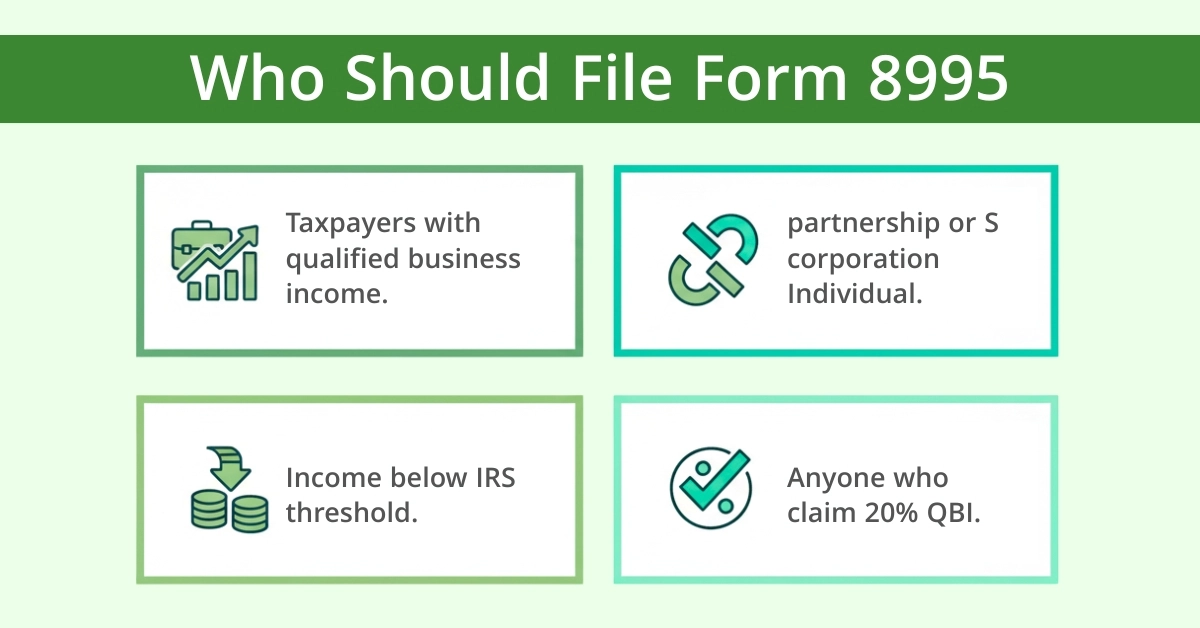

Who Should File Form 8995

You should file Form 8995 if you meet both of the following conditions:

- Taxpayers with qualified business income from a sole proprietorship.

- Individuals with income from a partnership or S corporation.

- Those earning from certain rental activities that qualify as a business.

- Taxpayers whose taxable income is below the IRS threshold, making the simplified Form 8995 sufficient.

- Anyone who wants to claim the 20% Qualified Business Income (QBI) deduction without using the more complex Form 8995-A.

The income limits for 2025 (subject to IRS inflation adjustments) remain approximately:

- $197,300 for single filers (May change in 2026)

- $394,600 for married couples filing jointly (May change in 2026)

If your taxable income exceeds these amounts, you’ll likely need to use Form 8995-A instead, as additional calculations apply. Eligible taxpayers may include freelancers, consultants, small business owners, or landlords earning income through qualified real estate activities. At Acct Right PLLC, we help you determine who qualifies for Form 8995 and guide you through the proper filing process.

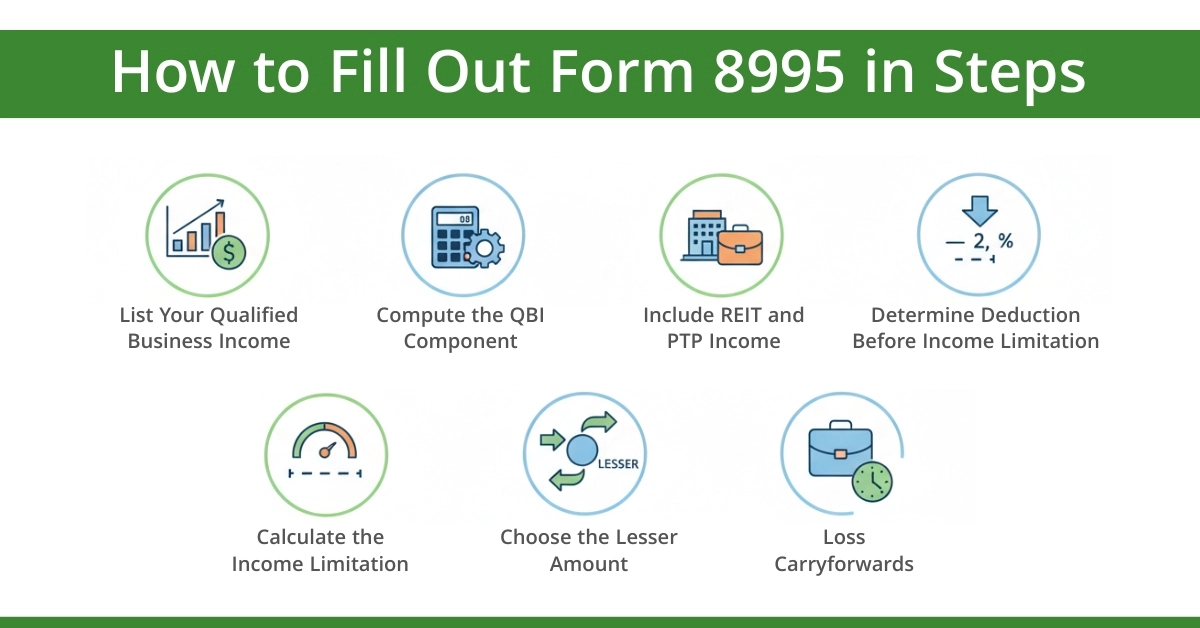

How to Fill Out Form 8995: Step-by-Step

Below is a walkthrough of each major section of Form 8995 instructions, using simplified language. Always confirm with the latest IRS instructions.

1. List Your Qualified Business Income (Lines 1-4)

- On Line 1 (columns a–c), enter up to five business names (or aggregated business names), their taxpayer identification numbers, and their qualified business income (QBI) or loss for 2025.

- On Line 2, sum all of those QBI amounts.

- Line 3 is for any carryforward of qualified business net loss from the prior year.

- Line 4 combines Lines 2 and 3 to show the total qualified business income for the year.

If your combined amount is zero or negative, you generally cannot claim a QBI deduction this year, but you will carry forward any net loss.

2. Compute the QBI Component (Lines 5)

Multiply Line 4 by 20% (0.20) to get the preliminary QBI deduction amount (before applying income limitation).

3. Include REIT and PTP Income (Lines 6-9)

- On Line 6, enter any qualified REIT dividends or qualified PTP income (or loss).

- Line 7 is for any carry-forward of REIT/PTP losses from the previous year.

- Line 8 sums those amounts. If zero or less, treat as zero.

- Line 9 is 20% of Line 8 (i.e., multiply by 0.20).

This is your REIT/PTP component of the QBI deduction.

4. Determine Deduction Before Income Limitation (Line 10)

Add Line 5 + Line 9 to get your total QBI deduction before income limitations.

5. Calculate the Income Limitation (Lines 11-14)

- On Line 11, enter your taxable income (before applying the QBI deduction).

- On Line 12, enter net capital gains (if any), plus qualified dividends, as required.

- On Line 13, subtract Line 12 from Line 11 (net amount subject to limitation).

- Line 14 is 20% of that result (i.e., multiply by 0.20).

This gives you the maximum allowed deduction under the income limitation.

6. Choose the Lesser Amount (Line 15)

- Compare Line 10 (deduction before limitation) with Line 14 (income-limited amount).

- The smaller of the two is your final QBI deduction for 2025. Enter that on Line 15 (and the same amount on your Form 1040).

7. Loss Carryforwards (Lines 16-17)

If your net qualified business income is negative, Lines 16 and 17 help you compute what you will carry forward for future years.

A simple example:

- Taxpayer’s qualified business income: $80,000

- QBI deduction: $80,000 × 20% = $16,000 deduction

Note: Form 8995 handles the QBI deduction, while Form 8949 reports investment gains and losses. Both require accurate reporting, and knowing one makes managing the other easier

How to Calculate the QBI Deduction Using Form 8995

The QBI deduction calculation is straightforward for most filers under the income threshold.

- Determine QBI – Identify net income from eligible businesses or qualified rental activities.

- Check Income Threshold – Confirm if your taxable income allows the simplified Form 8995 or requires Form 8995-A.

- Apply 20% Rate – Multiply QBI by 20% for the preliminary deduction, ensuring it does not exceed 20% of taxable income minus net capital gains.

- Adjust for W-2 Wages and Qualified Property – For higher incomes, consider limits based on wages paid and business property.

- Complete Form 8995 – Enter all QBI, income, and adjustments accurately to calculate the deduction.

- Report on Form 1040 – Transfer the final QBI deduction to reduce taxable income.

According to CPA and tax advisor Mark Steber says many filers overlook key income adjustments or thresholds that can reduce their deduction accuracy, here directly impacts your refund.

Common Mistakes to Avoid When Using Form 8995

To make sure your QBI deduction is correctly claimed, watch out for these pitfalls:

- Using the wrong form: If your taxable income exceeds the thresholds, using Form 8995 instead of 8995-A can lead to disallowed deductions.

- Incorrect classification: Mixing in non-qualified income (e.g., wages, capital gains, investment income) will distort your results.

- Omitting REIT or PTP income: If you have REIT dividends or publicly traded partnership income, they must be included correctly.

- Math or carryforward errors: Failing to track past losses or carryforwards properly.

- Not attaching the form to your return: IRS requires the form to be submitted along with your return.

At Acct Right PLLC, we specialize in helping small businesses, LLCs, and pass-through entity owners navigate complex tax rules, especially for Form 8995 instructions and maximizing the QBI deduction. Our services include:

- The first one is to decide which one to use: either Form 8995 or 8995-A.

- Checking your eligibility and income eligibility.

- Sufficient classification of income, REITs, and PTPs (Publicly traded partnerships).

- Avoiding errors to maximize your deduction

When you are not sure where to start or you have the comfort of knowing that you are claiming your QBI deduction correctly, our team is here to assist you in planning and filing with any confidence.

Conclusion:

The Qualified Business Income Deduction is a claim that everybody will need to correctly file Form 8995 in 2025. Compliance and savings do not depend on how you manage your taxes, but rather on how accurate you are. As the tax regulations change annually, it is essential to keep up with the changes or use the services of such professionals as Acct Right PLLC to ensure compliance with all requirements and the ability to obtain all possible benefits.

Disclaimer:

This blog is for information only, not legal or tax advice. Tax rules change, so please consult us. We provide tax and accounting services to help with your specific needs. Some images may be illustrative or AI-generated.

Frequently Asked Questions

What is the difference between Form 8995 and 8995-A?

Form 8995 is used by taxpayers who belong to the lower income bracket whereas form 8995-A is used by tax payers who have higher taxable income and they have to make some more calculations.

Is it possible to claim QBI deduction among self-employed individuals?

Yes, the majority of self-employed taxpayers and sole proprietors are eligible provided their income is less than the IRS threshold.

Must I include Form 8995 with my return?

Yes, when claiming the QBI deduction, you have to attach Form 8995 to Form 1040.

Can I file Form 8995 online?

Yes. Tax preparation software most often have the Form 8995 and will automatically compute an amount and deduct it when income and business information is entered.