In today’s busy business world, understanding the 1099-NEC instructions is essential if you hire independent contractors or make non-employee payments. The IRS processed a staggering 4.5 billion information returns in FY 2024, including millions of 1099-NEC forms, yet penalties for late or incorrect filings hit $60–$330 per form in 2025-26, contributing to millions in annual fines per IRS reports. AcctRight, the best financial industry in the USA to help entrepreneurs and professionals streamline their accounting and tax-reporting processes so they can focus on what they do best in their affairs.

This guide covers everything you need for 2025–26 — what the form is, what’s new, who must file, how to complete and e-file it, plus practical tips for a smooth submission.

What is the 1099-NEC?

Form 1099-NEC, or “Nonemployee Compensation,” is an IRS form used to report payments of $600 or more made to non-employees like independent contractors, freelancers, and professionals for business services.

Why it Matters:

- It’s a compliance requirement for businesses that use contractors or freelancers.

- Filling it out incorrectly or failing to file can lead to penalties and added administrative headaches.

- Proper implementation helps maintain clean books, accurate vendor tracking, and better year-end tax preparation.

For 2025-26, keep an eye on thresholds: direct sales of $5,000 or more in consumer products for resale trigger a checkbox in Box 2. And don’t forget backup withholding: If a recipient doesn’t provide a valid TIN, you might need to withhold 24% and report it.

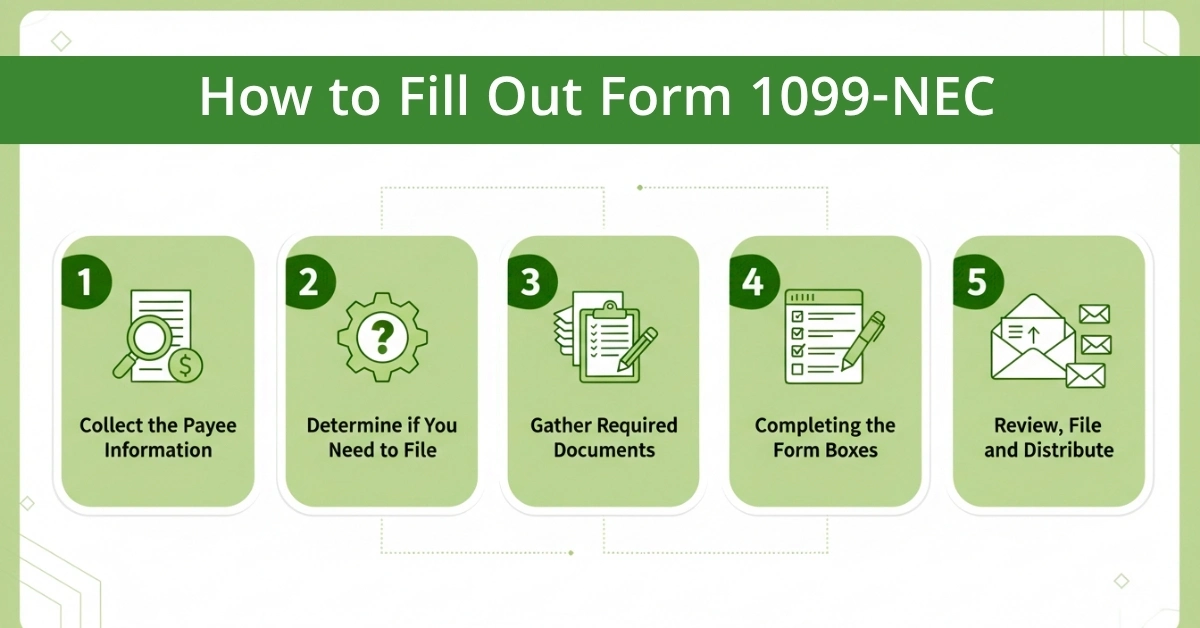

Form 1099-NEC Instructions: How to Fill Out Easily

Form 1099-NEC reports nonemployee compensation of $600 or more. Use it if you’re a business paying non-employees in your trade or business. File by January 31, 2026 (or next business day if it falls on a weekend/holiday). Provide Copy B to the recipient by the same date. E-file if filing 10+ returns total.

Step 1: Collect the Payee Information (Form W-9)

Before you pay a contractor, collect a properly completed Form W-9 (name, TIN, address). Without it you risk backup-withholding and penalties.

Step 2: Determine if You Need to File

- Did you pay someone who is not your employee (i.e., independent contractor, freelancer) for services in your trade or business?

- Is the total $600 or more for the year?

- If yes, you must complete Form 1099-NEC.

Exceptions: Don’t file for payments to corporations, wages (use W-2), rent/royalties (use 1099-MISC), or personal payments.

Step 3: Gather Required Info

- Your business details: Name, address, TIN, phone.

- Recipient’s details: Name, address, TIN.

- Payment amounts: Total nonemployee pay, any withholding, state info if needed.

Step 4: Completing the Form Boxes

- Box 1: Enter the total non-employee compensation of $600 or more (services, fees, commissions).

- Box 2: If you made direct sales of consumer products totaling $5,000+ to one person for resale (buy-sell or commission basis), you may check the box in Box 2 instead of using Form 1099-MISC.

- Box 3: Excess golden parachute payments (new for 2025).

- Box 4: Federal income tax withheld (backup withholding) if applicable.

- Boxes 5-7: State information (only if applicable) — these are optional unless your state requires.

- Payer’s Name/Address/TIN/Phone: Your business info at top.

- Recipient’s Name/Address/TIN: Their info is below the payer section. Truncate TIN on recipient’s copy (show last 4 digits).

- Account Number (Optional): Your internal reference.

- Check 2nd TIN Not. if Applicable: If IRS notified you of incorrect TIN twice in 3 years.

Step 5: Review, File, and Distribute

- Double-check: Match totals, correct TIN format (e.g., XXX-XX-XXXX for SSN), no personal payments.

- Common mistake: Forgetting attorneys’ fees (always report in Box 1).

- File with IRS: E-file (preferred, via FIRE system) or mail Copy A + Form 1096 by Feb. 2, 2026.

- Paper filers: Use red-ink Copy A.

- Send to recipient: Copy B by Jan. 31 (mail or electronic if consented).

- Keep records: Retain Copy C for 4 years.

- Corrections: File a new form marked “Corrected” with updated info; don’t void originals.

We know filling out this form can be complex, which is why our financial advisors are always available to assist you—contact AcctRight Pllc for help anytime.

Electronic Filing & Mailing 1099-NEC Forms

Opt for e-filing? Instructions simplify the process:

- Mandatory E-Filing: Required via IRS FIRE system if filing 10+ info returns total (incl. 1099-NEC).

- Paper Option: For <10 returns, use official red-scannable Copy A; PDFs on plain paper risk rejection.

- Mailing Addresses: State-specific; check instructions or Combined Federal/State Program for details.

At Acct. Right, PLLC, we handle complete filing (e-file or paper) to ensure IRS receipt and full compliance.

Form 1099-NEC Due Dates and Filing Instructions

To stay compliant, note the 1099-NEC filing deadlines for 2026:

- Recipient Copy B: Provide to the payee by January 31, 2025.

- IRS Copy A: File by February 2, 2026 (paper or e-file).

- State Filing: Follow state-specific rules or the Combined Federal/State Filing Program if applicable.

Late or incorrect filings may lead to penalties. Our business tax preparation experts ensure all submissions are timely and accurate.

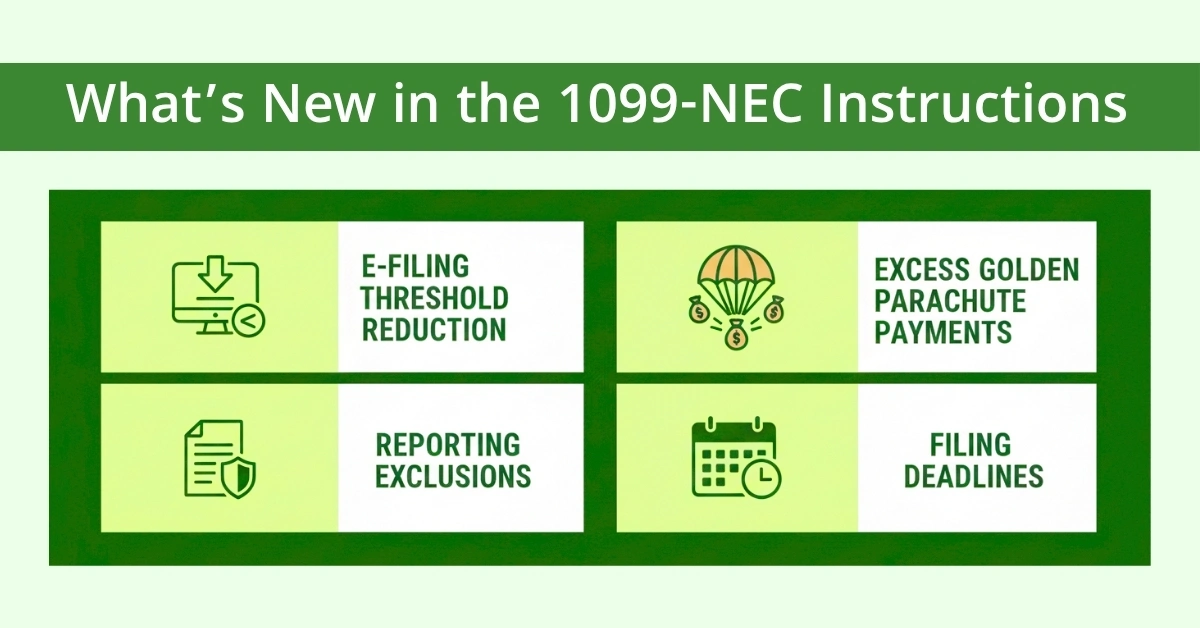

What’s New in the 1099-NEC Instructions

Staying current is key. The IRS has updated the instructions for filing year 2025 and beyond:

- E-Filing Threshold Reduction: The mandatory electronic filing threshold for information returns has been lowered to 10 returns.

- Excess Golden Parachute Payments: The same document clarifies that excess golden parachute payments are now reportable on Form 1099-NEC, box 3, which is new for 2025-26.

- Reporting Exclusions: Box 1 on Form 1099-NEC is not used for section 6050R cash payments for fish purchases; payments via credit cards or third-party networks are reported on Form 1099-K instead.

- Filing Deadlines: Form 1099-NEC must be filed by January 31 (paper or electronic), while Form 1099-MISC is due February 28 (paper) or March 31 (electronic), with extensions possible for good cause.

Summary on How to Fill IRS 1099-NEC Form

- Gather the contractor’s Form W-9 before payment.

- Track payments under “Nonemployee Compensation.”

- Generate and review the 1099-NEC report in QuickBooks at year-end.

- Furnish Copy B to the contractor and file Copy A with the IRS.

- Retain records for 3–4 years.

To better understand how various IRS tax forms operate, check out our detailed guide on the IRS 1098-T Form — an essential resource for ensuring proper tax filing and compliance.”

Conclusion:

Understanding the 1099-NEC instructions for 2025-26 is easier when you follow clear steps and stay organised. Make sure you collect W-9s, track payments correctly, and file by February 2 to avoid IRS penalties. Keeping up with e-filing rules and updates helps your business stay compliant and stress-free. Whether you use QuickBooks or other software, double-check your entries before submitting.

At Acct. Right, PLLC, we make filing your 1099 NEC simple and accurate, so you can focus on running your business with confidence while we handle your tax reporting needs.

Disclaimer:

For informational purposes only, this is not tax or legal advice. Tax laws change, so consult a professional for your specific needs. We provide accounting and tax support. Some images may be illustrative or AI-generated.

Frequently Asked Questions

Can I use Form 1099-MISC instead of 1099-NEC?

No, for most non-employee compensation (services by non-employees) you must use Form 1099-NEC. Using the wrong form can trigger IRS confusion and penalties.

Do I need to send the recipient’s copy to the IRS?

No, you provide Copy B to the recipient. The IRS receives Copy A (and for paper filings, Form 1096). The recipient does not file Copy B with the IRS.

What if I missed the deadline or made a mistake?

You should file a corrected or voided return as outlined in the “Corrections” section of the IRS instructions. Late filings may incur penalties.

Does payment via PayPal or credit card require Form 1099-NEC?

Not necessarily. If payment is processed via a third-party settlement network and you receive a 1099-K, you may not issue a 1099-NEC for that amount.

What is the 1099-NEC due date for 2025?

January 31 is the key date for both furnishing recipient copies and filing with the IRS for Form 1099-NEC.

What's the difference between 1099-NEC and 1099-MISC?

NEC is for non-employee compensation, and MISC is for other income, such as rents.