If you’ve recently received money from a retirement account, you might be staring at a tax form wondering, “What is a 1099-R form?” You’re not alone. Every year, millions of Americans receive this critical tax document after taking distributions from pensions, IRAs, 401(k)s, or annuities. Knowing what an IRS Form 1099-R entails is about more than just following the rules. It is about avoiding costly tax mistakes and maximizing your retirement income strategy.

In this Acct. Right, PLLC guide, we will walk you through everything to help you stay informed and compliant

What is a 1099-R Form?

Form 1099-R is an IRS information return that reports distributions totaling $10 or more from retirement and tax-deferred accounts. When you take money out of retirement accounts, the IRS wants to know because most distributions create taxable income.

According to Investopedia, Form 1099-R reports distributions from a retirement account so the IRS can track whether they’re taxable or not. Unlike a W-2, it covers retirement-related distributions instead of wages

Why this form matters for your taxes:

The 1099-R form contains several critical numbers your tax preparer needs:

- Gross distribution (Box 1): Total amount withdrawn

- Taxable amount (Box 2a): Portion subject to income tax

- Federal income tax withheld (Box 4): Prepayments to the IRS

Who Receives Form 1099-R?

You’ll receive a 1099-R if you took distributions from profit-sharing plans and 401(k)s, traditional and Roth IRAs, pension, annuities, and survivor income benefit plans. You can get a 1099-R by financial instructions that must be mailed to you by January 31 each year. If you haven’t received it by early February, contact your plan administrator.

Who issues 1099-R forms?

Any entity managing retirement accounts:

- Financial Institute

- Insurer

- Pension plan administrators

- Former employers with 401(k) plans

For business owners issuing these forms to former employees, Acct. Right, PLLC offers complete business tax preparation services, including 1120S and 1065 filings with proper 1099-R compliance.

It’s possible to receive multiple 1099 Rs in a year, but according to the IRS Instructions for Form 1099 R, a Self-Directed IRA only generates a 1099 R when there’s an actual distribution or rollover.

Note: While the 1099‑R reports retirement distributions, other types of income are reported using forms like the IRS 1099‑NEC, which covers payments to independent contractors.

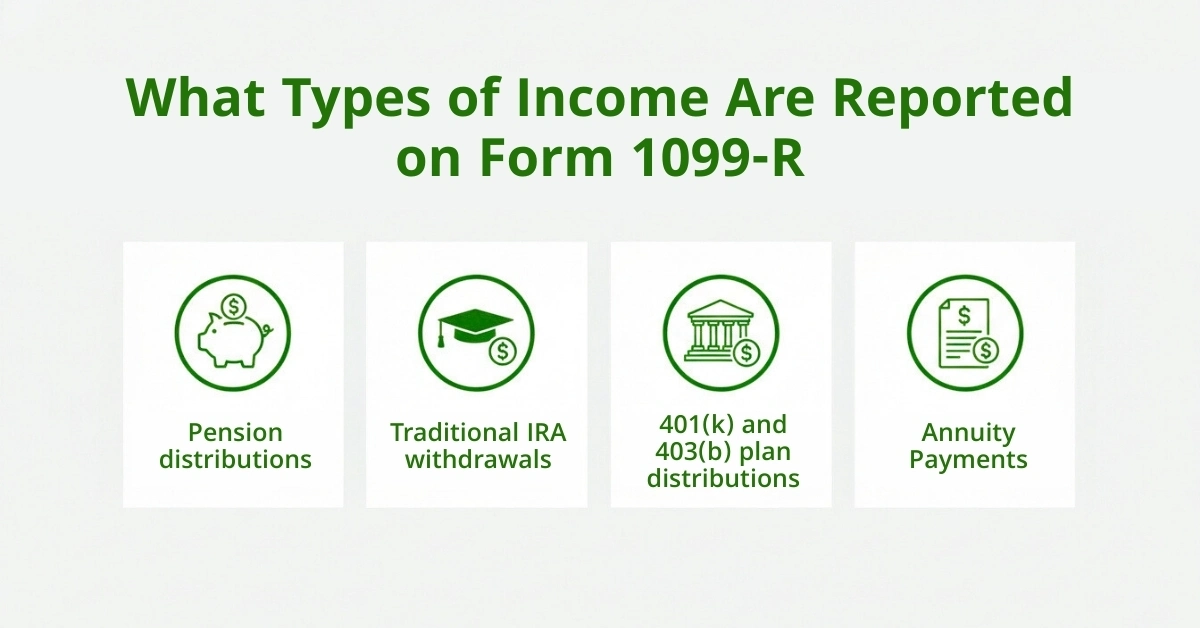

What Types of Income Are Reported on Form 1099-R

Form 1099-R captures various retirement distributions:

Taxable Distributions:

- Pension distributions (regular or lump-sum)

- Traditional IRA withdrawals and conversions

- 401(k) and 403(b) plan distributions

- Annuity payments from qualified contracts

Potentially Non-Taxable Distributions:

- Direct rollovers to another retirement plan

- Roth IRA withdrawals

- Qualified Charitable Distributions (QCDs) (2025 instructions) from IRAs

- Loans treated as distributions (if defaulted)

Even non-taxable distributions are reported. For instance, a direct rollover is coded as G in Box 7, signaling a non-taxable event to the IRS.

Key Boxes on Form 1099-R Explained:

Key Boxes on Form 1099-R Explained:

Reading a 1099-R can feel daunting, but understanding the key boxes helps. Here’s a breakdown of the most important fields you’ll see:

| Box | What It Means |

| Box 1: | Total amount distributed to you in the tax year. |

| Box 2a | Portion of the distribution that is taxable |

| Box 2b | Payer is unsure of the taxable portion |

| Box 4 | Federal tax withheld |

| Box 5 | After tax contributions or account basis |

| Box 7 | Distribution code (normal, early, death, rollover, etc.) |

Understanding these boxes helps you, or your tax professional, correctly report distributions on your return, compute taxable amounts, and avoid errors.

Acct. Right, PLLC provides Fractional CFO Services that include reviewing these boxes quarterly for high-net-worth clients, ensuring distribution strategies align with tax planning goals.

Understanding 1099-R Distribution Codes

Distribution codes on Form 1099-R determine tax treatment. Here are the most common:

- Code 1: Early distribution (<59½), no known exception: Taxable + 10% penalty (unless you qualify)

- Code 2: Early distribution, exception applies: Taxable but no 10% penalty

- Code 3: Disability: Typically exempt from penalty

- Code 4: Due to death: Paid to beneficiary; tax treatment varies by relationship

- Code 7: Normal distribution (age 59½+): Standard taxable income

- Code G: Direct rollover: Non-taxable event

- Code H: Direct rollover (Roth 401(k) to Roth IRA): Non-taxable if qualified

- Code Q: Qualified Roth IRA distribution: Tax-free and penalty-free

- Code Y: Qualified charitable distribution (NEW 2025): Excluded from income

When Are 1099-R Forms Due?

- To recipients: January 31 (postmarked)

- To IRS (paper filing): February 28

- To IRS (e-file): March 31

Most forms arrive in late January. Missing forms should be addressed immediately with the plan administrator. Late filings can incur penalties from $60-$630 per form.

Filing and Reporting Requirements for IRS 1099 Form

As a recipient, you don’t file the Form 1099-R itself. You report the income on your tax return. However, issuers are responsible for filing it with the IRS

- Include the 1099-R with your tax return only if federal tax was withheld (BOX 4) and you’re filing a paper return.

- E-filers don’t attach the form, but should have it available.

- If no tax was withheld but distributions are taxable, still report the amounts as income on 1040 (or 1040-SR/1040-NR, as applicable).

Report Form 1099-R on Your Tax Return

Where do I report 1099-R income? For most taxpayers, it flows to:

- Line 4a (IRA distributions) or Line 5a (pensions/annuities): Enter gross distribution

- Line 4b or 5b: Enter taxable amount

- Label “rollover” or “QCD” if excluding amounts from income

Schedule 1: Additional taxes (like 10% early withdrawal penalty) are calculated here using Form 5329.

Calculating Your Taxable Amount

How to figure the taxable amount on 1099-R depends on the account type:

Traditional IRAs with After-Tax Contributions

Use Form 8606 to calculate the pro-rata rule. All your traditional, SEP, and SIMPLE IRAs are treated as one. The formula:

Taxable % = (Total pre-tax balance) ÷ (Total IRA balances)

- Roth IRAs:

1. Contributions: Always tax-free.

2. Earnings: Tax-free if 5-year rule met AND age 59½ or older. - 401(k) Rollovers: Direct rollovers (Code G) are non-taxable. 60-day rollovers require you to deposit the full amount, including any withholding.

Acct. Right, PLLC provides personalized 1099-R worksheets for clients, especially real estate investors juggling multiple income streams on Schedule E.

Getting a Copy of Form 1099-R (Lost or Missing Forms)

How to get a 1099-R if you never received it:

- Check your online account portal (most issuers post PDFs)

- Call the plan administrator (they can reissue)

- For old forms, request a tax transcript from the IRS

Where can I get a 1099-R form if the issuer is defunct? The IRS can provide wage and income transcripts showing what was reported.

Filing Form 1099-R Instructions for Businesses

Who must file 1099-R forms? Any business, nonprofit, or government agency making $10+ in distributions.

How to file a 1099-R form:

- E-file 1099-R: Required if filing 10+ forms

- Paper file: Use official IRS red-ink forms (not downloadable)

- Include Form 1096: Transmittal summary for paper filers

Where to file 1099 R: IRS processing centers (varies by location). E-filing transmits directly.

Deadlines: January 31 to recipients; February 28 (paper) or March 31 (e-file) to IRS.

Penalties for missing the 1099 submission deadline start at $60 per form. Small businesses with profit-sharing plans often overlook this. Our 1120 and 1065 preparation includes full 1099 compliance.

Common IRS 1099-R Form Errors & Corrections

Even with retirement plans, mistakes happen. Some common issues:

- Missing 1099-R for distributions

- Wrong distribution code (Box 7)

- Incorrect or omitted Box 5 (basis)

- Incorrect Box 4 withholding

- Failure to report on 1040

- Late filing by the issuer, which could delay your ability to file on time.

If there’s an error, contact the payer immediately and request a corrected 1099-R. For recipients who already filed, you may need to amend your tax return (e.g., via Form 1040X) depending on the change. A qualified tax services provider can help manage these corrections, including paperwork and communications with the IRS.

Conclusion

Understanding what is a 1099-R form is empowers you to catch errors, optimize tax outcomes, and avoid IRS notices. With new 2025 QCD reporting rules and increasingly complex retirement landscapes, professional guidance isn’t just helpful, it’s essential.

Whether you’re a real estate investor managing self-directed IRA distributions, a healthcare professional with multiple retirement plans, or a small business owner issuing these forms, Acct. Right, PLLC brings Dallas-based expertise to your unique situation.

Don’t let a confusing 1099-R derail your tax planning. Contact us today to schedule a consultation and ensure your retirement distributions work for you, not against you.

Disclaimer:

This article aims to inform and educate, and is not intended to provide legal or tax advice. Tax regulations may change, so please consult our team. Certain images in this post are for illustration and may be AI-generated.

Frequently Asked Questions

Do I get a 1099-R for a direct rollover between retirement accounts?

Yes. Even trustee-to-trustee rollovers are reportable. You’ll receive a 1099-R with a distribution code (G or H) and typically zero taxable amount.

I received multiple 1099-R forms in one year. Do I report all?

Yes. Each 1099-R must be reported. Distributions from IRAs, pensions, annuities, or conversions may have different tax rules and must be reported individually.

What does it mean if Box 2b is checked (“Taxable amount not determined”)?

Box 2b indicates the payer isn’t sure of the taxable portion. You or your tax professional must calculate taxable versus non-taxable amounts.

Is every 1099-R distribution taxable?

No. Qualified Roth IRA withdrawals, direct rollovers, certain annuity exchanges, or return of after-tax contributions can be partially or fully non-taxable. The distribution code determines taxability.

I never received my 1099-R by early February. What should I do?

Contact your plan administrator or financial institution. They are required to issue the form and can provide a replacement if it’s lost.