Filing Form 1099 accurately and on time is a critical responsibility for businesses that pay contractors, vendors, or independent professionals. When you miss the deadline or submit incorrect information, the IRS imposes penalties that can quickly add up. Understanding the form 1099 penalty for late filing and how to avoid these costly fines is essential for protecting your business finances.

In this guide, we will walk you through exactly what you face if you file late and, more importantly, how to protect your business.

What Is the Penalty for Late Filing Form 1099?

The IRS penalty for late filing Form 1099 is imposed when you fail to file correct information returns with the IRS. It is also designed to encourage timely reporting of payments such as non-employee compensation, dividends, or miscellaneous income.

According to the IRS, these penalties apply when you fail to file the form correctly or on time with the agency, or when you don’t provide accurate statements to payees.

The penalty for late filing of 1099 forms varies based on:

- If you fail to file Form 1099-NEC by the deadline of January 31, you may face IRS penalties. For the other 1099 forms, the deadlines can vary slightly, and an extension may also be available.

- The penalties range from $60 to $660 per form, depending on your business size and filing timelines.

- Whether your business qualifies as “small” (average annual gross receipts ≤ $5 million for the prior three years)

- If the failure was due to reasonable cause or intentional disregard

For your information: The IRS charges interest on unpaid penalties from the due date until paid in full, making prompt resolution essential.

IRS Form 1099 Penalities Based on Filing Time and Form Type

Based on Time Line:

- Filed within 30 days late: If you file within 30 days of the due date, the penalty is $60 per form.

- Filed 31-60 days late: Filing more than 30 days late but before August 1, pushes you into the second tier. The penalty for filing 1099 form late in this window jumps to $130 per form or $130 per form

- Filed more than 60 days late: If you file after August 1 or don’t file at all, the penalty for filing Form 1099 late reaches $330 per form.

| Days Late | Penalty Per Form | Maximum for Small Businesses (Gross Receipts ≤ $5M) | Maximum for Large Businesses |

| Up to 30 days | $60 | $239,000 | $683,000 |

| 31 days to August 1 | $130 | $683,000 | $2,049,000 |

| After August 1 or if not filed | $330 | $1,366,000 | $4,098,500 |

| Intentional disregard | Minimum $680 or 10% of the reported income | No maximum | No maximum |

These amounts apply per form, and remember, penalties can double if you fail to provide both the IRS copy and the recipient statement.

Penalties By Form Type

Penalties for late or incorrect 1099 Forms, including:

1. Form 1099-NEC

- Deadline: January 31 to both recipients and IRS (paper or e-file)

- Penalty: The penalty for filing Form 1099-NEC late follows the standard tiered structure above.

2. Form 1099-MISC

- Deadline: January 31 to recipients; February 28 (paper) or March 31 (e-file) to IRS

- Penalty: The penalty for late filing of form 1099-MISC applies separately to each copy.

If you file the IRS copy late but send recipient copies on time, you may still face half the potential penalties.

Common uses:

- Rent payments (Box 1)

- Legal settlements (Box 10)

- Healthcare payments

Real estate professionals must pay special attention to this form.

3. Form 1099-DIV

What is the penalty for filing a Form 1099-DIV late? It follows the same tiered structure, with the same $60-$340 per form rates.

Financial institutions and investment firms must file these for dividend payments exceeding $10.

4. Form 1099-R

- The penalty for late filing of Form 1099-R applies to retirement plan administrators and financial services firms.

- With no minimum threshold, any distribution requires filing.

5. Form 1099-INT

- Banks and lenders must file for interest payments over $10.

- The penalty structure mirrors other forms.

Note: If you’re concerned about penalties for late 1099 filing, understanding IRS Form 8809 is essential. This form allows businesses to request an extension for submitting 1099s, helping avoid costly late-filing penalties and stay compliant with IRS deadlines.

Penalties Based on the Size of Businesses

Small Business Penalties

The penalty for business filing late 1099 form varies based on company size. Small businesses (those with average annual gross receipts of $5 million or less) benefit from lower maximum penalty caps but still face per-form penalties that can quickly accumulate.

Large Business and Repeated Filing Issues

Larger businesses face substantially higher maximum penalties. Additionally, the penalty for filing 2016 1099 forms late or any prior year corrections can compound when combined with current-year penalties. The IRS maintains records of past filing behavior, and businesses with patterns of late filing rarely receive penalty relief.

At Acct. Right, PLLC, we serve businesses across various industries, including real estate professionals, healthcare providers, and e-commerce companies. Our fractional CFO services include comprehensive tax planning that prevents repeated compliance issues by implementing systematic filing processes.

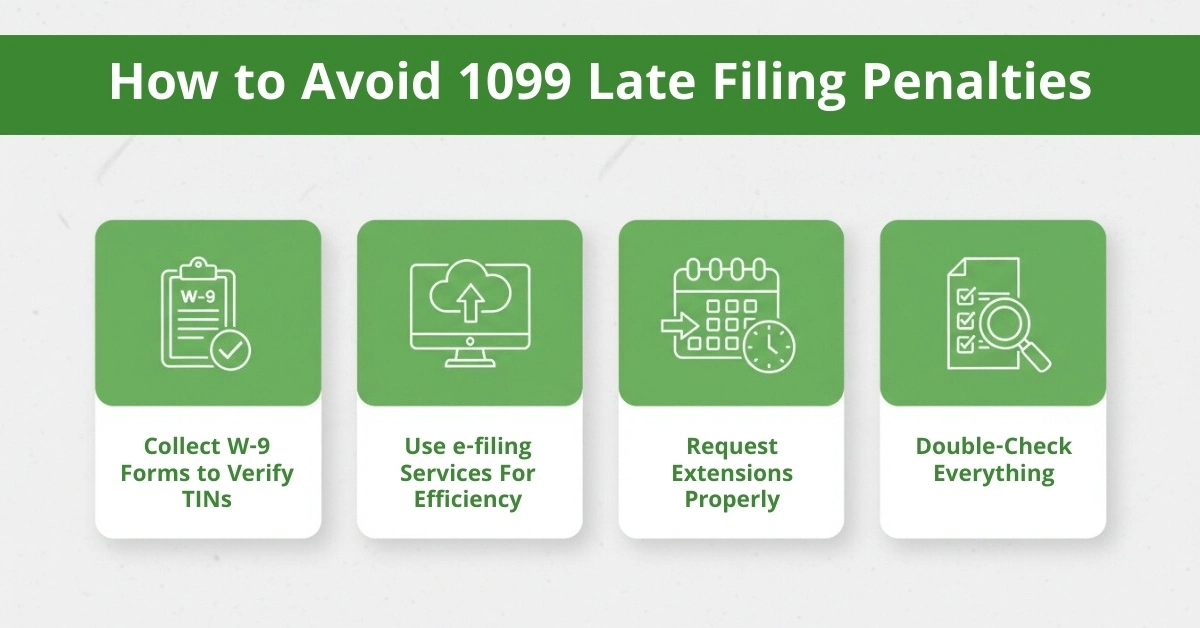

How to Avoid 1099 Late Filing Penalties

To avoid penalties, here are the simple steps:

- Collect W-9 Forms upfront to verify taxpayer identification numbers (TINs)

- Use e-filing services for efficiency, and it is required for most businesses filing 10 or more information returns in a year.

- Request extensions properly for file Form 8809 for IRS copies (automatic 30 days). For Form 1099-NEC, automatic extension does not apply. Only hardship-based extensions may be granted.

- Double-check everything and also, and the IRS may waive penalties if you demonstrate reasonable cause.

You must show that you acted responsibly, and the failure occurred despite ordinary business care and prudence.

Did You Know? According to information from leading tax preparation platforms, electronic filing dramatically reduces rejection rates and provides real-time status updates, helping businesses identify and correct errors within the 30-day penalty window.

Conclusion:

If you are a businessman, it is important for you to understand the Form 1099 late-filing penalties. Because they impact contracts, vendors, or investors. If you fill out the form late and provide wrong or incorrect information so it can lead to fines that add up quickly. The good news is that these penalties are usually easy to avoid if you give complete and correct information. Collect W-9 forms early, keep accurate records, and file on time in written or electronic form. If you make a mistake and realize it so you want to request an extension to the IRS if needed. By staying organized and proactive, businesses can avoid Form 1099 late-filing penalties and remain compliant with IRS rules.

Frequently Asked Questions

Will the IRS catch a missing or late 1099?

Yes. The IRS matches 1099 filings with recipient tax returns using automated systems and TIN matching.

Is it better to file a 1099 late or not file at all?

Filing late is always better because penalties for not filing are significantly higher due to intentional disregard rules.

Can IRS penalties for late 1099 filing be waived?

Yes. The IRS may waive penalties if you can prove reasonable cause and demonstrate good-faith compliance efforts.

Can you file a 1099 after January 31?

Yes. You can file a 1099 after January 31, but penalties increase the longer the delay continues.

Will you go to jail for not filing Form 1099?

No. Jail time applies only to willful tax fraud. Late or missing 1099 filings usually result in financial penalties, not criminal charges.

Disclaimer:

The information here is general in nature and should not be considered legal or tax advice. Please consult our qualified tax team for advice related to your specific situation.