If you’re selling business property, rental real estate, farmland, or depreciated equipment in 2025, you must know how to report a business property sale to the IRS correctly. The primary form used is IRS Form 4797, which helps you report gains and losses from these sales for proper tax treatment.

At Acct. Right, PLLC, we want to ensure you understand every detail so you file accurately and maximise your tax benefits. In this guide, we will walk you through the 2025 edition of Form 4797, Section 1231 gains IRS reporting, and how to handle like-kind exchanges on IRS Form 4797. By following these instructions to file accurately, avoid penalties and also maximise your tax benefits.

What is IRS Form 4797?

The IRS Form 4797 is used to report the gains and losses in business property and trade, such as sales, exchanges, or involuntary conversions. It also applies to depreciation recapture under Sections 1245 (equipment and vehicle), 1250 (real estate), and these three: 1252, 1254, 1255 are for farmland, natural resources, intangible drilling, etc.

Taxpayers use Form 4797 for:

- Sales of business property held over one year (long-term).

- Ordinary gains or losses from property held under one year.

- Depreciation recapture on equipment, vehicles, or real estate.

- Recapture of Section 179 deductions if business use drops below 50%.

- Installment sales and like-kind exchanges linked to business property.

In short, if you sold property and utilize this money for business or income production. The Form 4797 is likely the correct form to report the sale.

Purpose of Form 4797

- Report sale, exchange, or involuntary conversion of business or income-producing property.

- Recapture depreciation or Section 179 deductions when the property’s business use decreases.

- Determine whether gains or losses are ordinary or section 1231 (netted under special rules).

For 2025, no substantive changes are expected from the 2024 version, though inflation adjustments may affect penalty rates. File if gross proceeds from Form 1099-B or 1099-S exceed $600 for business assets. Failure to report triggers penalties under Section 6721, up to $330 per form for intentional disregard.

Who Needs to File Form 4797?

You must file Form 4797 if:

- You sold or exchanged business real estate (e.g., rental properties, office buildings).

- You sold depreciated equipment or vehicles used in your business.

- You converted business property involuntarily (e.g., fire, theft, condemnation).

- You need to recapture depreciation previously claimed.

- You sold farmland, timber, or natural resources subject to IRS rules.

Common Confusion: Many taxpayers are unsure whether to use Schedule D or Form 4797.

- Schedule D = investment property (stocks, bonds, personal assets).

- Form 4797 = business property and rental property subject to depreciation.

Note: When reporting the sale of business or income-producing property, taxpayers must file Form 4797. However, for capital gains and losses on securities or investment property, the process often begins with Form 8949, which then flows into Schedule D

IRS Form 4797 Instructions (2025 Updates)

The IRS publishes annual updates to Form 4797 instructions. For 2025, key updates included:

- Updated references to IRS Pub 544 (Sales and Other Dispositions of Assets).

- Adjusted reporting for installment sales (Form 6252).

- Clarification on like-kind exchanges (Form 8824).

When completing Form 4797 for 2025, always reference:

- Form 4797 IRS Instructions (2025 edition).

- IRS Publication 544 for property sale rules.

- Form 4684 for casualty/theft losses.

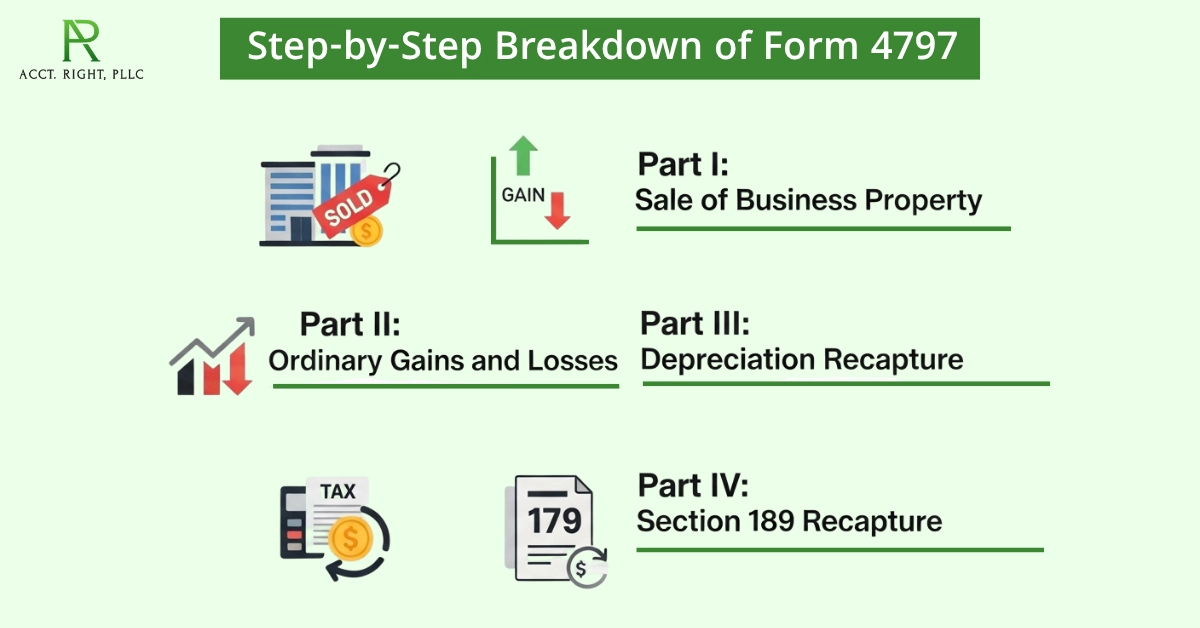

Step-by-Step Breakdown of Form 4797

Part I: Sale of Business Property (Held Over One Year)

This section reports long-term business property sales.

Lines 1-9 cover:

- Line 1a-c: Report gross proceeds, gains, or losses from Form 1099-S or 1099-B.

- Line 2-7: Enter description, acquisition date, sales date, gross sales price, depreciation taken, cost basis, and resulting gain/loss.

- Line 8: Apply prior-year Section 1231 losses.

- Line 9: Calculate net Section 1231 gain or ordinary loss.

Example:

A landlord sells a rental house purchased for $300,000, claims $50,000 depreciation, and sells it for $400,000.

- Sale price = $400,000

- Adjusted basis = $250,000

- Gain = $150,000 (portion taxed as depreciation recapture, rest as capital gain).

Part II: Ordinary Gains and Losses (Held Less Than One Year)

Report short-term property transactions.

Lines 10-18 cover:

- Gains or losses from property sold within one year.

- Section 1231 losses carried from Part I.

- Ordinary income from instalment sales or like-kind exchanges.

Example:

You sell machinery after 8 months for a gain that’s reported here as ordinary income, not capital gain.

Part III: Depreciation Recapture (Sections 1245, 1250, etc.)

This section reports the recapture of depreciation.

- Section 1245 property: Equipment, machinery, vehicles.

- Section 1250 property: Buildings and real estate with depreciation.

- Section 1252/1254/1255: Special cases (farmland, natural resources).

Lines 19-32: Capture adjusted basis, depreciation claimed, and recapture income.

Example:

Selling office equipment with $20,000 depreciation → full $20,000 taxed as ordinary income, not capital gain.

Part IV: Section 179 Recapture (Business Use Drops Below 50%)

If you claimed a Section 179 deduction on equipment/vehicle but later reduced business use under 50%, you must recapture prior deductions.

Lines 33-35 calculate the recapture.

Example: A business car with Section 179 deduction is converted to personal use → report recapture here.

Common Mistakes with Form 4797

- Reporting rental property on Schedule D instead of Form 4797.

- Forgetting to include depreciation recapture.

- Misreporting land sales (land has no depreciation but is still reported on Form 4797 if business-related).

- Skipping instalment sale reporting (Form 6252 in Pdf).

Sample Form 4797 (2025 Example)

| Property Sold | Sale Price | Adjusted Basis | Depreciation | Gain/Loss | Reported On |

| Rental Property | $400,000 | $250,000 | $50,000 | $150,000 | Part I & III |

| Equipment (6 mo) | $20,000 | $15,000 | $5,000 | $5,000 | Part II |

| Office Building | $600,000 | $400,000 | $100,000 | $200,000 | Part I & III |

Always use the latest version of IRS Form 4797 and instructions. For example, the 2024 Instructions already include most rules in effect.

Comparison: Form 4797 vs. Schedule D vs. Form 8949

| Feature | Form 4797 | Schedule D | Form 8949 |

| Type of Property | Business/rental property | Investment property | Capital assets (detailed reporting) |

| Depreciation Recapture | Yes | No | No |

| Section 1231 Treatment | Yes | No | No |

| Typical Users | Business owners, landlords | Investors, individuals | Investors with stock/asset sales |

| Linked Forms | 6252, 4684, 8824, 4562 | 8949, 1099-B | Schedule D, 1099-B |

Penalties for Incorrect or Late Filing

- Late filing → Standard failure-to-file penalties.

- Incorrect reporting → Up to 20% accuracy penalty under IRC §6662.

- Intentional disregard → Up to $330 per form (IRC §6721).

- IRS may also impose interest on unpaid tax from the due date.

Always attach Form 4797 to the correct return (Form 1040, 1065, 1120, or 1120-S).

Key Tips for Compliance & Filing

- Use the worksheets provided in the instructions to compute recapture amounts.

- Keep detailed records: purchase date, business vs personal use, depreciation schedules.

- Review your entries carefully: e.g., holding period, whether the property was used in business in the required years.

- Attach any required statements for property sales beyond the lines available.

Conclusion:

If you are selling or exchanging the property in 2025, IRS Form 4797 is your best choice. If you sell or exchange your real estate, equipment, or machinery, this Form 4797 will help you with accurate reports of gains and losses. If you don’t know how to manage these things, follow the instructions that are there to guide you very well. And always keep in mind that every year you must check the new updates, things must be changed, like Section 179 deductions or like-kind exchanges. If you are ever stuck in a complex situation, always consult your tax professional. They will keep everything in order. So, fill the Form right now to save your time and other complications.

Always reference the latest Form 4797 instructions (2025 edition) and consult Acct. Right a tax professional for complex transactions.

Frequently Asked Questions

What is IRS Form 4797 used for?

To report sales, exchanges, involuntary conversions, and depreciation recapture of business/income-producing property.

Do I report Section 179 property on Form 4797?

Yes, when property is sold or business use falls below 50%, you must recapture Section 179 deductions on Form 4797.

How is land reported on Form 4797?

Land has no depreciation but is still reported if it was used for business or rental purposes.

How does Form 4797 connect to Schedule D?

Net gains from Form 4797 may flow to Schedule D for final capital gain reporting.

What happens if I fail to file Form 4797?

You may face IRS penalties, interest, and loss of favorable Section 1231 treatment.

What if I have more properties than lines on the form?

Attach a statement listing additional assets; label appropriately, include the same columns (proceeds, cost basis, etc.).

Disclaimer: This post is for information only, not legal or tax advice. Tax rules change, so please consult a professional. We provide tax and accounting services to help with your specific needs. Some images may be illustrative or AI-generated.