If you’ve ever stared at your tax forms, wondering why there’s an extra sheet called Schedule 1 Form 1040, you’re not alone. Taxes can feel like a puzzle, but breaking it down with the financial experts of AcctRight makes it manageable. According to the IRS, the Schedule 1 Form 1040, sometimes called the Schedule 1 tax form, is used to report additional types of income and adjustments. This IRS 1040 Schedule 1 ensures your Federal Income Tax Schedule 1 filing is complete and compliant.

We’ll cover what Schedule 1 is, who needs it, how to fill it out, and even some tips to make filing smoother. By the end, you’ll feel confident handling your 1040 Schedule 1 or know when to reach out to our team for help.

What Is Schedule 1 Form 1040?

So, what is IRS Schedule 1 exactly? In simple terms, Schedule 1 on 1040 is an attachment to your main Form 1040, 1040-SR (for seniors (age 65 or older)), or 1040-NR (for non-residents) that handles additional income and adjustments to income. It’s not for everyone, but if you have side gigs, rental properties, or certain deductions, it’s essential. The form splits into two parts:

Part I: Additional Income:

You’ll use Schedule 1 if you received:

- Business income (reported from Schedule C)

- Rental income or royalties (from Schedule E)

- Unemployment compensation

- Prize or award money

- Gambling winnings

- Farm income

Part II: Adjustments to Income:

Part II of Schedule 1 focuses on adjustments to income, which can help reduce your adjusted gross income (AGI). These include:

- Educator expenses

- Student loan interest deductions

- Self-employment tax deductions

- IRA contributions

- Health savings account (HSA) deductions

- Moving expenses for active-duty military members

Why does this matter? Your AGI affects eligibility for credits, deductions, and even things like student aid. Missing Schedule 1 taxes could mean overpaying or facing penalties. For instance, if you’re self-employed, reporting Schedule 1 business income here ties into your overall return.

Who Needs to File Schedule 1?

Not everyone needs to file Schedule 1 (Form 1040). You must file it if you have any additional income or deductions not listed directly on your Form 1040, such as freelancing or self-employment income, rental income, business profit or loss, farm income, or unemployment compensation.

You Likely Need it if:

- You have additional income from Schedule 1 Line 10, like taxable refunds from state taxes, alimony received (for pre-2019 agreements), or prizes and awards.

- You’re self-employed with business income or loss from Schedule C.

- You earned from rentals, royalties, or partnerships via Schedule E.

- Farm income? That’s Schedule F territory.

- Other extras: Gambling winnings, cancellation of debt, or even Alaska Permanent Fund dividends.

On the Adjustments Side:

- Teachers claiming educator expenses.

- Reservists or artists with certain business costs.

- Deductions for health savings account (HSA) contributions, IRA deduction, or student loan interest.

If all your income is from wages, interest, dividends, retirement, or Social Security (as listed on Form 1040), skip it.

Note:

If you’re an expat or earn foreign income, remember to use Form 2555 to calculate what’s excluded before reporting the rest on Schedule 1. Don’t list the excluded amount as a negative number; just make sure you only report taxable income to avoid double-counting.

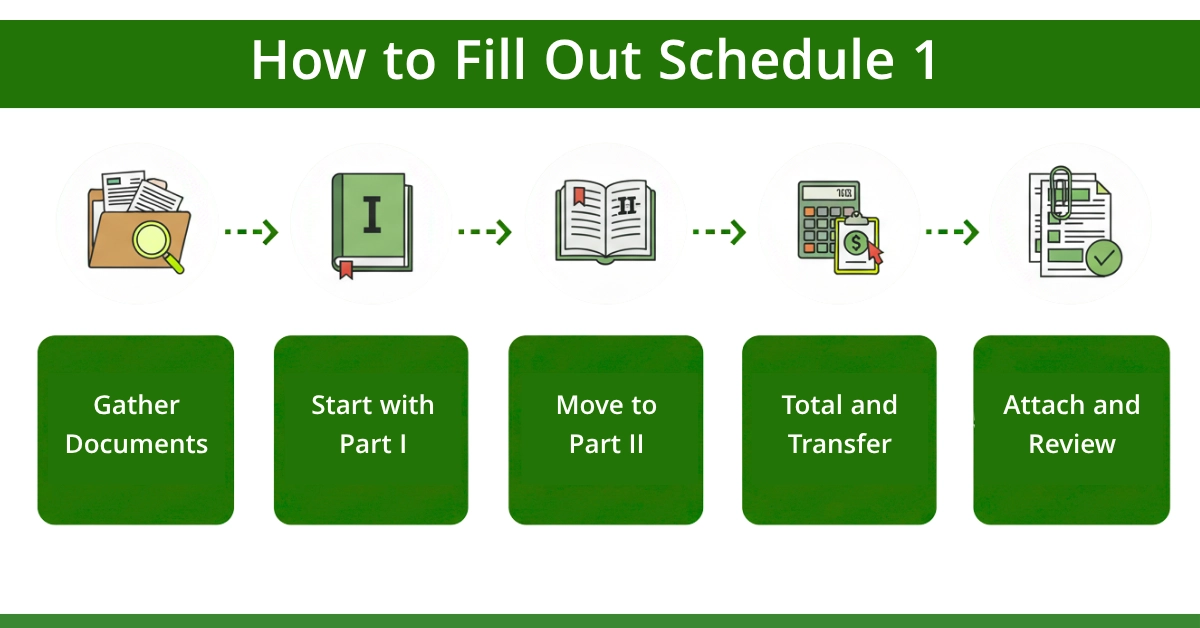

How to Fill Out Schedule 1: Step-by-Step Instructions

Filling out Schedule 1 instructions doesn’t have to be daunting. Grab your docs and follow along.

- Gather Documents: W-2s, 1099s (like 1099-NEC for freelance), state refund notices, and supporting forms (Schedule C, E, etc.).

- Start with Part I: Enter amounts line by line. For Schedule 1 Lines 3+6, pull from attached schedules, Line 3 for business, Line 6 for farms.

- Move to Part II: Claim adjustments with proof, like loan statements for Line 21.

- Total and Transfer: Calculate Lines 10 and 26, then plug into Form 1040.

- Attach and Review: Include with your return. Use software for auto-calcs.

How to file Part I Schedule 1 (Form 1040 – Additional Income

- Line 1: Taxable state refunds.

- Line 2a: Alimony received.

- Line 3: Business income or loss (attach Schedule C).

- Line 5: Rental income, royalties, partnerships (attach Schedule E).

- Line 7: Unemployment compensation.

- Line 8z: Other income (e.g., jury duty, digital assets).

Total on Line 10 and add to Form 1040.

Part II – Adjustments to Income

- Line 11: Educator expenses (up to $300).

- Line 13: HSA deduction (Form 8889).

- Line 15: Half of self-employment tax.

- Line 17: Self-employed health insurance.

- Line 21: Student loan interest (up to $2,500).

- Line 24z: Other eligible adjustments.

Sum on Line 26 and subtract from AGI on Form 1040.

Note: Schedule 1 (Form 1040) reports extra income like business or rental earnings, while Form 4797 records gains or losses from selling business assets. The calculated amount on Form 4797 is transferred to Schedule 1, impacting your total income on Form 1040. Learn more in our detailed guide on IRS Form 4797 Instructions.

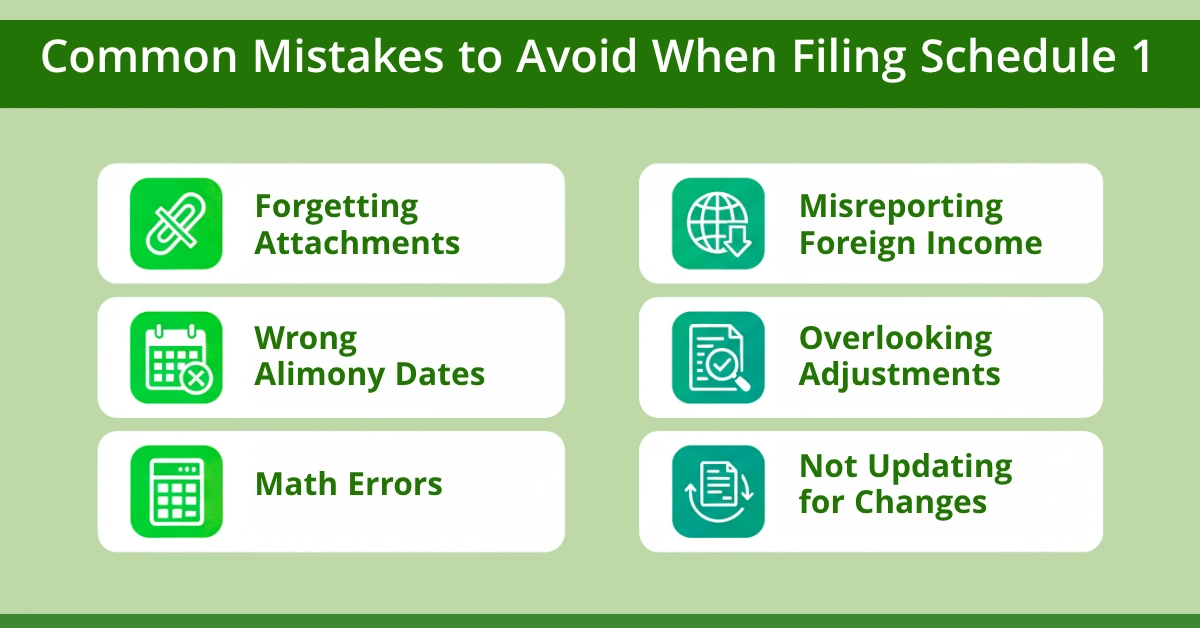

Common Mistakes to Avoid When Filing Schedule 1

These errors are common in many filings, but they’re completely avoidable with proper attention and understanding.

- Forgetting Attachments: No Schedule C for business income? Your return gets rejected.

- Wrong Alimony Dates: Mismatch on Lines 2b/19c triggers audits.

- Math Errors: Double-check additions, software helps, but verify.

- Misreporting Foreign Income: Expats, note that Form 2555 must be reported as negative.

- Overlooking Adjustments: Missing student loan interest costs refunds.

- Not Updating for Changes: With 2025’s new rules, old habits bite.

Avoid these pitfalls by organizing early. If audited, our IRS representation services can step in.

Schedule 1 Tips and Tricks

Here are some Schedule 1 tips and tricks suggested by finance experts of AcctRight:

- Track Everything: Use apps for expenses, and deduct more on adjustments.

- Maximize Self-Employment Deductions: Bundle health insurance and retirement.

- File Electronically: Schedule 1 online via Free File if under $79,000 AGI.

- Download Schedule 1: Get IRS Schedule 1 form free from irs.gov, no cost!

- Check Eligibility: For educators or self-employed, these cuts add up.

- Plan Ahead: If gigging, estimate quarterly taxes to avoid underpayment.

Combine with credits like Earned Income, our planning services at Acct. Right, PLLC ties it all together.

How to Get Schedule 1 for Free

You can download Schedule 1 forms directly from the IRS or complete Schedule 1 online through their Free File system.

Here’s how:

- Go to irs.gov/forms-pubs

- Search for “Schedule 1 (Form 1040)”

- Click “Download PDF”

- Fill it out electronically or print and attach it to your Form 1040

If you work with Acct. Right, PLLC, our team can handle this for you, ensuring you use the latest IRS version and avoid outdated forms.

Why Work with Financial Experts for Schedule 1 Filing

At Acct. Right, PLLC, we take pride in helping individuals and businesses across Texas to all parts of the USA.

Here’s how we can help:

- Tax Preparation for Individuals (1040, Schedule C, Schedule E)

- Business Tax Filing (1120, 1120S, 1065)

- Fractional CFO Services for growing companies

- Financial Planning and Consulting

Our team doesn’t just prepare your taxes; we ensure your Schedule 1 and other forms reflect accurate income reporting and smart deductions to minimize your tax liability.

Conclusion

Filing your Schedule 1 Form 1040 accurately can make a big difference in your tax outcome. Whether you’re reporting business income, claiming educator expenses, or adjusting for IRA contributions, understanding how to complete Schedule 1 ensures compliance and potential savings.

At Acct. Right, PLLC, our financial experts combine expertise, technology, and personal attention to help clients file with confidence. From individual tax returns to business tax strategy, we’re your trusted partner in navigating every tax form accurately and on time.

Disclaimer:

This article is just general information and isn’t personal tax or legal advice. Tax rules may change, so contact us for guidance. Some images may be examples or AI-generated.

Frequently Asked Questions

What is Schedule 1 (Form 1040)?

It’s an extra IRS form for reporting income like side gigs or alimony and deductions like student loans. Attach it to Form 1040 if needed.

Who needs to file Schedule 1?

You need it if you have business income, unemployment, rentals, or deductions like educator expenses. Skip it if only wages and standard deduction.

What goes on Schedule 1?

Income: refunds, alimony, business profits, and gambling. Deductions: student loan interest, IRA, and self-employment tax. It adjusts total income on Form 1040.

How to fill out Schedule 1?

Part I: list extra income. Part II: list deductions. Add totals, transfer to Form 1040. Use 1099s and the IRS guide. E-file for ease.

Schedule 1 vs. Schedule 2 or 3?

- Schedule 1: extra income/deductions.

- Schedule 2: extra taxes.

- Schedule 3: credits/payments.

All are attached to 1040 but handle different tax parts.