Since January 1, 2025, a large number of American businesses have been obliged to file a Beneficial Ownership Information (BOI) Report under the Corporate Transparency Act (CTA). The purpose of this new rule is to introduce transparency in company ownership structure and fight illegal practices, including money laundering and tax evasion, as mandated by the Financial Crimes Enforcement Network (FinCEN).

But the real question most small business owners are asking: “Who needs to file a BOI report?”

Simply put, a BOI report identifies the individuals who own or control a business entity. It ensures that shell companies or anonymous corporations can’t hide their true owners behind layers of paperwork.

This guide walks you through every important detail, from understanding who qualifies as a reporting company to exemptions, deadlines, and filing steps, in plain, human language.

Understanding the BOI Report

The BOI report collects details about the beneficial owners of a company — meaning the individuals who ultimately own or control the entity. A beneficial owner is any individual who:

- Holds or exercises control over 25% or more of the company’s ownership stake

- Exercises substantial control over the company’s decisions or operations.

The BOI report ensures that regulators and law enforcement can trace ownership and prevent businesses from being used as anonymous fronts for illegal activities.

Fact Check: According to FinCEN’s official estimate, around 32.6 million existing entities are required to file their initial BOI reports in 2025-26, and approximately 5 million new filings are expected each year thereafter.

What Is the Corporate Transparency Act (CTA)?

The Corporate Transparency Act, passed in 2021 and enforced by FinCEN, requires most U.S. corporations, LLCs, and comparable business entities to report their beneficial owners. It’s part of a broader initiative by the U.S. Treasury Department to create transparency within the corporate structure of U.S. businesses.

It’s part of a broader initiative by the U.S. Treasury Department to create transparency within the corporate structure of U.S. businesses.

Purpose of the CTA:

- Prevent shell companies from concealing illicit funds.

- Support law enforcement and national security.

- Strengthen financial system integrity.

- Protect small businesses from unfair competition.

Who Needs to File a BOI Report?

According to FinCEN, reporting companies fall into two main categories:

1. Domestic Reporting Companies

Corporations, LLCs, or entities created by filing with a Secretary of State or similar office. Most small businesses and limited partnerships fall here.

2. Foreign Reporting Companies

Entities formed under the laws of a foreign country but registered to do business in the U.S. If your business was created or registered by filing documents with your state government, such as an LLC, corporation, or limited partnership, it’s likely you must file a BOI report.

Firms like Acct. Right, PLLC helps businesses identify reporting obligations, verify ownership data, and ensure timely submission, making compliance stress-free.

Who Is Exempt from Filing a BOI Report?

While the rule applies broadly, FinCEN outlines 23 categories of exemptions.

Some of the key exemptions include:

- Publicly traded companies (already reporting to the SEC).

- Banks, credit unions, and insurance companies.

- Accounting firms and registered investment advisors.

- Inactive entities that meet specific inactivity conditions.

- Large operating companies with:

- Over 20 full-time employees in the U.S.

- A physical office in the U.S.

- More than $5 million in annual U.S. revenue.

If your business meets any of these criteria, you might be exempt from BOI filing. However, for most small businesses, especially LLCs and single-member corporations, filing is mandatory.

Deadlines and Filing Requirements for BOI

- Existing Companies (formed before January 1, 2025): You have until January 1, 2026 to submit your first BOI report.

- New Companies (formed in 2025 or later): You must file within 90 days of registration.

Updates:

If ownership information changes (for example, a new owner joins or an address changes), you must update your BOI report within 30 days. FinCEN estimates that the average time to prepare and submit a BOI report is about 90 minutes, depending on company complexity.

Average preparation and filing time is about 90 minutes, but complexity may vary. Partnering with Acct. Right, PLLC ensures deadlines are met, and filings are accurate.

What Information Is Required in a BOI Report?

The report must include the following details about each beneficial owner and company applicant:

For the Company:

- Legal name and trade name (DBA).

- Principal business address.

- Jurisdiction of formation.

- Taxpayer Identification Number (TIN or EIN).

For Each Beneficial Owner:

- Full legal name.

- Date of birth.

- Residential address.

- Identification document (e.g., passport or driver’s license).

This data must be submitted through FinCEN’s BOI e-filing system.

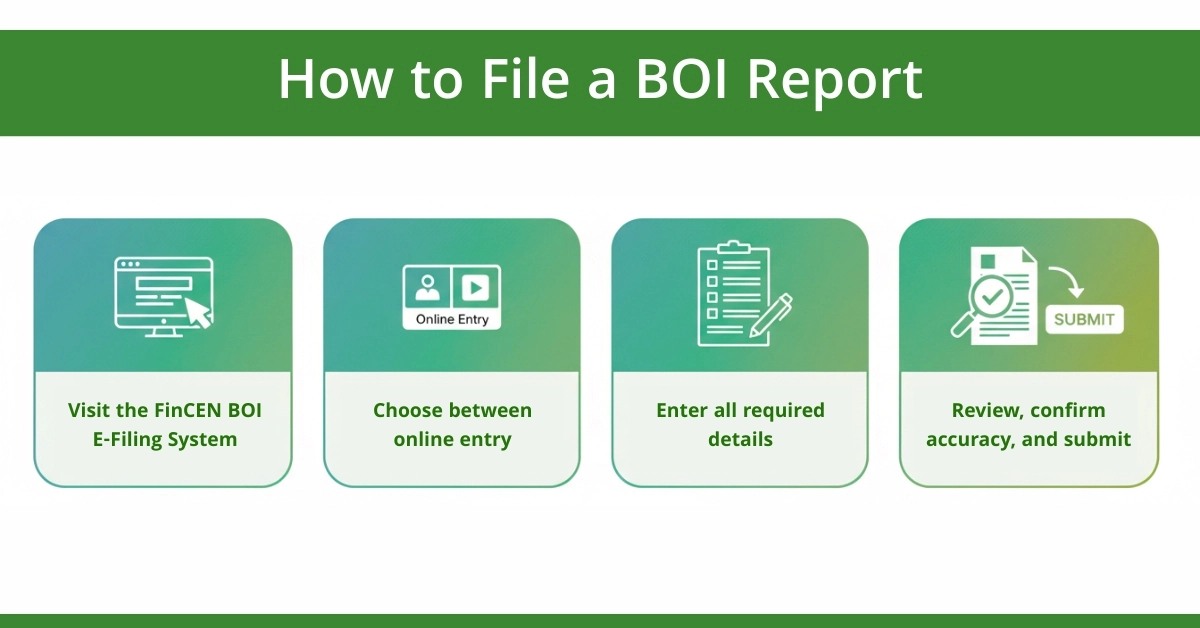

How to File a BOI Report: Step by Step

The process is relatively straightforward:

- Visit the FinCEN BOI E-Filing System.

- Choose between online entry or PDF upload.

- Enter all required details for the company and beneficial owners.

- Review, confirm accuracy, and submit.

You’ll receive a confirmation once the report is filed.

Expert Insights: According to financial compliance expert Laura McDermott, CPA, “Small businesses should treat BOI filing like any other core compliance requirement — keep records organized, verify ownership details, and document every change to stay compliant.”

Penalties for Not Filing a BOI Report

Not filling or updating a BOI report may be severely punished:

- None, Civil fines of up to $500 per day (until the violation is stopped).

- The following are criminal penalties such as monetary fines of up to 10,000 dollars or a 2-year jail term.

FinCEN has taken a decisive step to outline that ignorance of the law will not be a defense, particularly when the agency offers a lot of guidance and support.

Ignorance of the law is not a defense, so professional support from Acct. Right, PLLC can prevent costly mistakes.

Why BOI Compliance Matters for Small Businesses

Beyond the legal requirement, BOI compliance offers important benefits for your business:

- It enhances transparency and credibility with banks, investors, and regulators.

- It reduces the risk of being flagged for suspicious activity.

- It helps maintain the integrity of your company’s reputation.

A verified BOI record also simplifies future processes such as opening business bank accounts or applying for federal contracts. Additionally, a verified BOI record can simplify bank account openings, federal contracts, and tax filings. With services like fractional CFO support and tax planning.

How Financial Companies Help with BOI Filing and Compliance

Financial and compliance firms play a crucial role in simplifying the BOI filing process. Here’s how they make compliance easier for businesses:

1. Determine Filing Eligibility

They review your business structure to confirm whether you’re required to file or qualify for an exemption — preventing unnecessary filings or penalties.

2. Verify Ownership Data

These firms help collect and validate owners’ details, ensuring documents like IDs and EINs meet FinCEN’s compliance standards.

3. File the BOI Report Accurately

Experts handle the entire submission process via FinCEN’s portal, reducing the risk of errors or delays.

4. Manage Record Updates

Financial companies maintain secure records and promptly update ownership information when business changes occur.

5. Protect Sensitive Information

They use advanced encryption and secure data systems to safeguard your confidential ownership information.

Note: For a deeper understanding of who qualifies as a beneficial owner and the role of company applicants in BOI reporting, the team at Acct Right, PLLC provides a detailed guide on Company Applicant vs Beneficial Owner. This resource can help clarify the filing requirements and ensure compliance with BOI regulations

What People Share Stories on Forums

A user in the small business forum commented: “I thought this was another unnecessary government form, but after reading more, I realized it’s actually meant to protect small businesses from being impersonated by shell companies.”

One more user said: “I filed my BOI report in under 30 minutes. It’s not complicated, but you must ensure every detail matches your business registration records.”

These real-world insights show how business owners are adapting to the new FinCEN requirements without stress — as long as they stay informed and act early.

Conclusion:

The BOI reporting requirement marks a significant shift in how the U.S. manages corporate transparency. While it may seem like another layer of paperwork, it’s designed to protect legitimate business owners and strengthen financial integrity. If your company is a corporation, LLC, or partnership registered through your state, you likely need to file a BOI report — unless you clearly fall under one of the listed exemptions.

Make sure to:

- File by the correct deadline.

- Keep ownership records up to date.

- Seek professional advice when uncertain.

As financial expert Laura McDermott suggests, “Think of BOI reporting as an investment in your company’s credibility, not just a compliance obligation.”

With comprehensive services, from BOI compliance to tax planning, financial modeling, and fractional CFO services, Acct. Right, PLLC helps small businesses thrive while staying compliant.

Disclaimer:

The information provided here is general and not intended as legal or tax advice. Always consult a qualified professional for guidance. Our firm provides accounting and tax services. Images may be illustrative or AI-created.

Frequently Asked Questions

Do single-member LLCs need to file a BOI report?

Yes. Single-member LLCs are not exempt unless they meet the large company criteria.

Does a nonprofit have to file?

Most 501(c) organizations are exempt, but they should verify their exemption status.

How often must I file a BOI report?

Only once, unless your ownership or business information changes.

What information must my company report?

A reporting company must provide its legal name, principal U.S. business address, formation jurisdiction, tax ID (if issued), plus each beneficial owner’s full name, date of birth, residential address, ID document, and image.

Do I need to update a BOI report if ownership changes?

Yes. If any required information about the company or its beneficial owners changes, an updated BOI report must be filed no later than 30 calendar days after the change.