To businesses and other financial professionals, filing information returns is very important within the dedicated time. The deadlines vary by form type and filing method. Late submission of deadlines may bring penalties, additional stress, and compliance problems. That is why it is important to appreciate IRS Form 8809.

This guide will cover all the facts about the IRS 8809 form: what it is, who uses it, where to submit it, and why it is better to seek the assistance of a financial expert like Acct. Right, PLLC itself. This blog is written by experts with complete detail.

What is IRS Form 8809?

From 8809, officially titled “Application for Extension of Time to File Information Returns,” that allows payers or filers of certain information returns, such as 1099 Series (e.g., 1099-INT, 1099-DIV), W-2G, 1097, 1098, 1095, 3921, 3922, 8027, 1094-C) W-2s, 1099s, 3921/3922, 5498 series, W-2, 1099-NEC and 1095 series forms, to request an extension for filing these returns.

Some filers search specially for the Form 8809 PDF or “8809 ext” when preparing their filings, since this is the official IRS document needed to request more time.

It should be mentioned that 8809 is not applied to income tax returns, as well; it is utilized solely to provide information returns. This form is provided by the IRS as a way of ensuring that companies remain in compliance with the stipulations in the event of unfortunate events or large volumes of filing that could lead to an inability to meet the deadline.

Instructions For Form 8809

1. Avoid IRS Penalties

Failure to file information returns on time without using the IRS Form 8809 extension may result in significant penalties. Depending on the number of returns and the lateness in filing, penalties can add up quickly. Filing the 8809 extension prevents these unnecessary fines.

2. Maintain Compliance

Companies can find themselves in problems such as the unavailability of payee details, system malfunctions, or personnel shortages that will not allow them to put in their documents on time. Filing Form 8809 IRS enables businesses to submit a formal request for an extension and stay in line with the IRS requirements.

One of the small business owners posted on one of the more popular online forums that it was highly important to file Form 8809 during the first year of your business, giving out W-2 forms. The absence of it would mean that the business would have been punished in case of late submission as a result of the delay in gathering employee information.

3. Strategic Time Management

Using the instructions for Form 8809 and filing early gives your team time to gather accurate information and reduce filing errors. This is especially valuable for businesses with large reporting volumes.

Who Should Use Form 8809?

IRS Form 8809 is designed for filers of specific information returns, including:

- W-2s and W-2Gs

- 1042-S

- 1097, 1098, 1099 series forms (1099-MISC, 1099-NEC, etc.)

- 3921 and 3922

- 5498 series

- 8027 (Employer’s Annual Return of Tip Income)

- 1095-B and 1095-C forms (ACA healthcare reporting forms)

The 8809 is not used for income tax returns, including corporate or individual tax filings.

Second 30-Day Extension:

Entities that experience extenuating circumstances, such as disasters, illnesses of responsible personnel, or delays in receiving necessary data, can request a second 30-day extension under specific conditions.

When Should Form 8809 Be Filed?

Form 8809 IRS should be filed before the due date of the information return that you wish to extend. It might be disqualified by filing it too early or too late. In case the business provides a multitude of information returns with varying deadlines, the earliest deadline should be used to complete the Form 8809. This pre-filing will be in line with the requirements and avoid unnecessary sanctions.

IRS Penalty Details for Late Filing

Failure to file W-2s and 1099s without a timely Form 8809 extension can result in:

- $60 for each return submitted up to 30 days late.

- $130 for each return submitted more than 30 days late but before August 1.

- $340 for each return filed after August 1 or not filed at all.

Maximum penalties for small businesses vs large corporations differ. No mention of “intentional disregard” penalties, which can be $570 per return or more. Penalties are higher for intentional disregard cases.

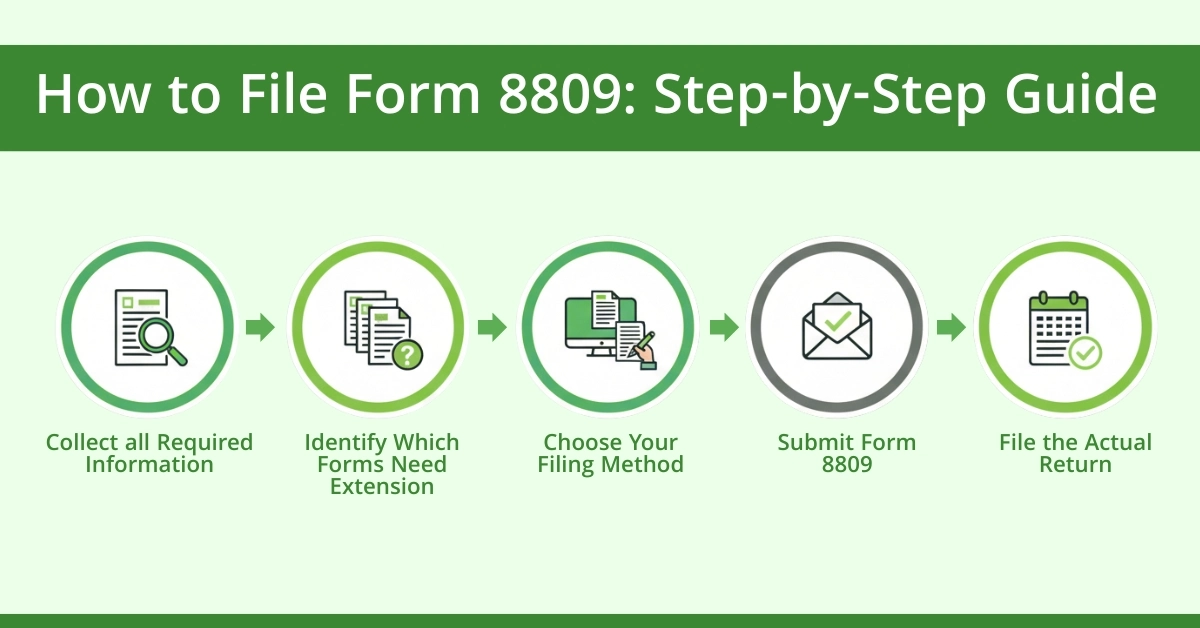

How to File Form 8809: Step-by-Step Guide

Step 1: Collect all Required Information

First, collect all the important details before filling out the form, including:

- Filer or payer’s name, address, and taxpayer identification number (TIN or EIN)

- Contact person details, including phone number and email

- The type of information returned needs extension

Step 2: Identify Which Forms Need Extension

Form 8809 allows you to mark multiple types of returns, such as W-2s, 1099s, and 1095 forms. Ensure you check the correct boxes for each form type that requires an extension.

Step 3: Choose Your Filing Method

- Electronic Filing (e-file): Many filers submit Form 8809 electronically through the IRS’s FIRE system. This provides a quicker process and, in most cases, automatic approval of a 30-day extension. W-2 forms, however, may not be eligible for automatic electronic extensions.

- Paper Filing: Some forms, especially certain 1099 forms or W-2s, must be submitted on paper.

Step 4: Submit Form 8809

After completing the form, submit it via your chosen method. For paper filings, make sure you send it to the correct IRS mailing address. For electronic filings, ensure confirmation of submission and acceptance.

Step 5: File the Actual Return

Once the extension is granted, you must file the information return within the extended timeframe. Failure to meet the new deadline can still result in penalties.

Expert Insights: Many organizations filing IRS Form 990, an annual information return for nonprofits, sometimes need extra time to compile accurate information. In such cases, IRS Form 8809 can be submitted to request an extension. For a detailed guide on Form 990 deadlines and filing requirements. Check our experts guide for proper insights.

Real-World Scenarios For Form 8809

Scenario A: Small Business Filing 1099s

A small staffing company was associated with the delayed gathering of contractor data on 1099-NEC forms. The possibility of filling Form 8809 offered them the additional 30 days to collect all the required information and make correct returns to avoid the impact of late-filing penalties.

Scenario B: Large Corporation with Multiple Return Types

A large corporation that has thousands of W-2s, dozens of 1095-C forms, and dozens of 3922 forms utilized Form 8809 to organize deadlines across the various departments. They could be on time by filing the earliest due date and could not receive a fine for late filing.

Scenario C: Financial Expert Experience

A CPA and financial analyst said that one of her clients had failed to file 5498-ESA Forms for a retirement plan. Submission of Form 8809 allowed her to receive the required extension and provide her colleagues with an opportunity to fix the data mismatch. This proactive solution would have saved the customer tens of thousands of dollars in possible fines.

Tips for Accurate and Stress-Free Filing

- Plan Early: Identify all your information returns and their deadlines at the start of the year.

- Internal Coordination: Ensure all departments collecting payee or employee data are aware of the schedule.

- Use E-Filing When Possible: Electronic submissions are faster and reduce errors.

- Document Reasons for Extension: Particularly for the second 30-day extension, maintain records of any extenuating circumstances.

- Engage a Financial Expert: Professionals at Acct. Right, PLLC ensures accurate filing, compliance, and strategic guidance.

Key Takeaways:

- Form 8809 is for information return extensions only, not tax payments

- File before the earliest due date of any return needing extension

- The standard extension is 30 days, with an optional second 30-day extension under specific conditions

- E-filing is recommended, but certain forms like W-2s require paper submission

- Engaging a financial expert reduces errors and ensures full compliance

Conclusion

Form 8809 is a very important form of tax filing by companies dealing with information returns. It enables companies to seek additional time to file forms such as W-2s, 1099s, and 1095s, which may avoid expensive fines and increase accuracy. Employment of trained financial experts also means that your extensions will be filed properly and in time, and with all the required documents. Such a proactive strategy can save your business a lot of time and stress, and possibly fines. Being a small business with just a couple of contractors or a large company working with thousands of returns, it is important to know how to file the Form 8809 and utilize it properly to ensure a smooth process and remain in line with the IRS regulations.

Acct. Right, PLLC helps businesses file the 8809 form, understand IRS 8809 requirements, and apply extensions correctly, saving time, stress, and money.