Filing IRS Form 990 Schedule A can feel massive for nonprofit organizations, but understanding the IRS Form 990 Sch A instruction doesn’t have to be complicated. If you’re a public charity confirming your tax-exempt status or a 501(c)(3) organization documenting public support, Schedule A is a critical component of your annual reporting obligations.

According to PwC, there are no major updates to the Schedule A 990 instructions beyond to continuous-use formats for certain schedules. But always consult AcctRight Pllc team for the latest updates. This comprehensive guide gives you complete Form 990 Schedule A instructions accurately. If you are filling the form for the first time or reviewing your approach, we’ll break it down step-by-step.

What is Form 990 and Schedule A?

IRS Form 990 is an annual information return filed by tax-exempt organizations with the IRS. It provides detailed financial information, governance practices, and program activities.

Schedule A (Form 990 Sch A) is specifically designed for organizations seeking public charity status or operating as private foundations. This schedule helps the IRS determine whether your organization qualifies for public charity classification or remains a private foundation.

Why Schedule A Matters

- Demonstrates public support for your organization.

- Determines tax-exempt status eligibility.

- Ensures transparency for donors and stakeholders.

- Helps avoid IRS penalties and audits.

Who Must File Form 990 Sch A?

Schedule A is generally required for:

- Public charities: Organizations that rely on public contributions, grants, or government funding

- Private foundations: Organizations funded primarily by a small group of donors or a family foundation

- 501(c)(3) organizations: Certain other tax-exempt organizations may need Schedule A if they claim public charity status.

For Your Information: Taxpayer Advocate Service confirms that organizations failing to attach Schedule A receive automatic IRS rejection of the returns, and the taxpayer or Electronic Return Originator (ERO) receives a rejection notice within 24-48 hours.

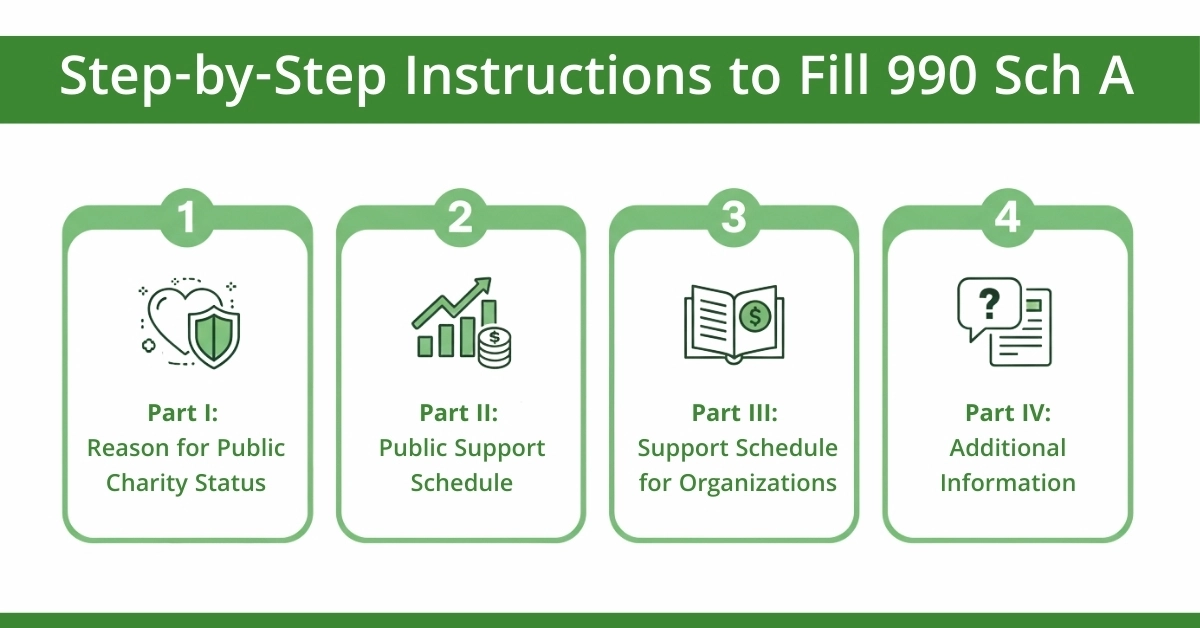

Step-by-Step Instructions to Fill 990 Sch A

Follow these 990 sch A instructions in sequence to ensure accuracy and compliance.

Part I: Reason for Public Charity Status

Check only one box on lines 1-12 that best describes your organization’s classification:

Lines 1-4: Automatically qualified organizations

- Line 1: Churches and conventions of churches

- Line 2: Schools and educational institutions (must also file Schedule E)

- Line 3: Hospitals and medical care organizations

- Line 4: Medical research organizations in conjunction with hospitals

These organizations are not required to complete the public support calculations in Part II or III

Lines 5-12: Public support-dependent organizations

- Line 5: Government-operated college/university support organizations

- Line 7: Publicly supported organizations receiving ≥33.33% support from government/public

Example: A community food bank qualifying under section 170(b)(1)(A)(vi) should check Line 7 and complete Part II

- Line 8: Community trusts meeting public support tests

- Line 10: Section 509(a)(2) organizations (program service revenue-based) (must complete Part III)

- Line 12: Supporting organizations (must complete Parts IV-VI)

Part II: Public Support Schedule

This section applies to Line 5, 7, or 8 filers and calculates public support using only gifts, grants, and contributions.

Key Calculation Steps:

- Line 1: Enter total contributions, gifts, and grants (excluding unusual grants)

- Line 5: Calculate excess contributions exceeding 2% of total support (excluding government/public charity contributions)

- Line 11: Total support for all 5 years

- Line 14: Public support percentage = Line 13 ÷ Line 11

Part III: Support Schedule for Organizations

For Line 10 filers, this broader test includes program service revenue:

- Lines 1-3: Include contributions, membership fees, and gross receipts from related activities

- Line 7a: Subtract amounts from disqualified persons

- Line 7b: Subtract large gross receipts exceeding $5,000 or 1% of total support

- Line 15: Public support must exceed 33⅓%

- Line 17: Investment income cannot exceed 33.33 %

Part IV: Additional Information

Complete only if you checked Line 12. All supporting organizations must complete Section A, plus:

- Type I: Sections A & B (operated/supervised by supported organization)

- Type II: Sections A & C (supervised/controlled in connection with)

- Type III Functionally Integrated: Sections A, D & E

- Type III Non-Functionally Integrated: Sections A, D & Part V

Information to Consider: For nonprofit organizations navigating IRS reporting, understanding Form 990 Schedule A is essential—much like how businesses benefit from guidance on entity compliance and reporting in resources like the BOI Reporting Guide.

Tips for Accurate Filing Schedule A: Common Mistakes and Solutions

Following schedule A 990 instructions tips from tax professionals helps avoid common errors that trigger IRS correspondence.

Common Mistakes to Avoid:

- Misclassifying Revenue: Ensure contributions aren’t incorrectly reported as program service revenue, and vice versa.

- Incomplete Five-Year Records: Maintain comprehensive records spanning the required five-year testing period. Missing even one year’s data can invalidate your public support test.

- Incorrect Support Percentage Calculations: Double-check all mathematical computations. The IRS systems automatically flag returns with calculation errors.

- Missing Supporting Documentation: Keep detailed records of all grants, contributions, and unusual transactions. Pilot emphasizes that documentation proves crucial during IRS examinations.

Point to Consider: Form 990 Schedule A ensures that nonprofits report their public support accurately and maintain compliance with IRS requirements, providing step-by-step guidance for completing contributions, grants, and other key information—much like how businesses rely on Form 941 instructions to navigate payroll and tax obligations.

Why Accurate Filing Matters

Accurate filing of Form 990 Sch A has several advantages:

- Maintains Tax-Exempt Status – Avoids risk of revocation by the IRS.

- Builds Donor Confidence – Transparent reporting encourages donations.

- Simplifies Audit Compliance – Proper records reduce audit risks.

- Supports Grant Applications – Many grants require proof of IRS-compliant status.

Conclusion:

Form 990 Schedule A is essential for nonprofits to maintain public charity status and demonstrate compliance with IRS requirements. Completing it accurately ensures your organization meets public support tests, reports contributions and grants correctly, and avoids penalties or audits. Following step-by-step instructions, keeping detailed five-year records, and documenting unusual grants are critical for a smooth filing process. Supporting organizations must also meet specific governance and notice requirements.

By carefully reviewing your IRS determination letter, double-checking calculations, and retaining records, your nonprofit can confidently file Schedule A, maintain transparency, and preserve its tax-exempt status.

Disclaimer:

The content provided here is for educational purposes and should not be relied on as legal or tax advice. We offer tax and accounting support. Always consult our team for the best guidance. Any images used are digitally generated for illustration only.

Frequently Asked Questions

What is the purpose of Form 990 Schedule A?

Schedule A helps nonprofits show they are public charities, document public support, report contributions and grants, and prove compliance with IRS public support rules.

Who needs to file Form 990 Schedule A?

Organizations filing Form 990 or 990-EZ that answer “Yes” to Part IV, line 1, including public charities, supporting organizations, and certain nonexempt charitable trusts.

How do I calculate public support on Schedule A?

Add contributions, grants, and gifts over five years, then divide public support by total support. Ensure percentages meet the 33.33 % public support requirement.

How are contributions from disqualified persons treated?

Contributions from disqualified persons are excluded from public support calculations to prevent individuals with a controlling interest from affecting the charity’s public support percentage.

What happens if an organization fails the public support test?

Failing the test may require reclassification as a private foundation, impacting tax-exempt status, reporting obligations, and eligibility for certain grants and donations.