If your nonprofit faces confusion over filing taxes, the IRS Form 990 instructions can seem overwhelming at first. But following them step by step keeps your organization compliant and transparent. For 2025, updates focus on compensation reporting, asset disclosure, and electronic filing. Understanding these instructions helps nonprofits avoid penalties and maintain trust.

In this comprehensive guide, we’ll walk you through everything you need to know about Form 990 instructions, including schedules, variants, common mistakes, and how AcctRight PLLC can simplify the filing process for your organisation.

Why IRS Form 990 Instructions Matter

You run a nonprofit to make a difference, but staying tax-exempt means meeting IRS rules. The IRS Form 990 instructions assist you in reporting your finances, activities, and governance to the Internal Revenue Service (IRS). This form demonstrates to donors, the public, and regulators how your group utilises its funds. Missing details or filing late can risk your status or penalties.

For 2025, updates focus on clearer reporting for compensation and assets. Understanding these instructions builds trust and avoids issues.

Who Must File Which IRS Form 990?

Not every nonprofit files the full Form 990. It depends on your size and type.

- Public charities usually file Form 990 if gross receipts top $200,000 or assets exceed $500,000 at year-end.

- Smaller groups with receipts under $200,000 and assets below $500,000 can use Form 990-EZ.

- If receipts stay under $50,000, send the simple Form 990-N e-Postcard.

- Private foundations file Form 990-PF for distributions and investments.

- Some religious organisations skip filing, but often do it voluntarily for openness.

Check your status with the IRS. For example, a community food bank with growing donations might switch from 990-N to 990-EZ. This keeps things straightforward. Pick the right one based on your finances. A startup charity might start with 990-N and upgrade as it grows.

Key Filing Requirements & Deadlines

- Report all revenue: donations, grants, program income.

- List expenses: program services, administration, fundraising.

- Detail governance: board members, policies.

- Disclose compensation: officers and top earners.

- Electronic filing: mandatory for most (exceptions for small groups with waivers).

- Keep records for at least three years for audits.

Deadline: 15th day of the 5th month after your fiscal year ends (e.g., May 15, 2026, for calendar year 2025).

Missed the Form 990 deadline? You can request up to a 6-month extension by filing IRS Form 7004 — a simple way to avoid penalties and get more time to file.

Step-by-Step Form 990 Instructions

Filling out how to fill out IRS Form 990 starts with the basics. Download the Form 990 instructions PDF from IRS.gov.

- Enter your EIN, name, and address in Part I.

- In Part III, describe your mission and top programs, spending at least 10% of space here.

- Part IV checks which schedules you need, like IRS Form 990 Schedule A for public status.

- Part V covers other filings, such as W-2s or foreign accounts.

- Part VIII lists revenue: contributions, program fees, and investments.

- Part IX details expenses: salaries, grants, and supplies.

- Part X shows the balance sheet: assets, liabilities.

- Part XI reconciles financial statements.

- Part XII confirms the accounting method.

- Be sure to electronically sign and submit Form 990 by the due date to avoid penalties.

For a library nonprofit, highlight book purchases in expenses. Take it line by line.

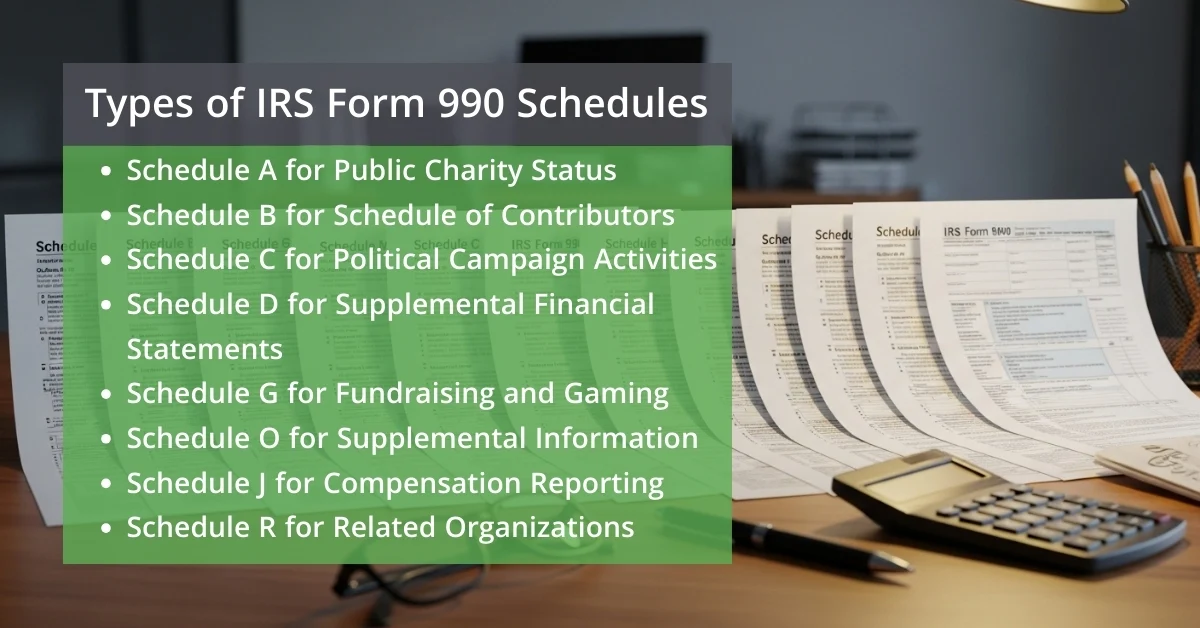

Types of IRS Form 990 Schedules

IRS Form 990 Schedule A: Public Charity Status

IRS Form 990 Schedule A confirms you’re a public charity, not a private foundation. It shows broad support from the public or government.

- Part I: Check your reason for public status, like a church or school.

- Part II: Support schedule calculates public support percentage from gifts and dues.

- Part III: If you’re a supporting organisation, explain ties to the main group.

- Part IV: Reason for reliance on public support.

For 2025, the support test uses a five-year average. A hospital relying on patient fees meets it easily. This avoids higher taxes on foundations.

Form 990 Schedule B: Schedule of Contributors

Use IRS Form 990 Schedule B to list major donors. It protects privacy but shows funding sources.

- List contributors giving $5,000 or 2% of the total, whichever is more.

- Include name, address, and amount, but not for public view.

- For 2025, thresholds adjust slightly for inflation.

Donors like foundations want this for accountability. An environmental group lists a big grant here. Keep it confidential.

IRS Form 990 Schedule C: Political Campaign Activities

If your nonprofit dips into politics, IRS Form 990 Schedule C reports it. 501(c)(3)s can’t endorse candidates.

- Part I: Lobbying report amounts spent influencing legislation.

- Part II: Political activities only for 501(c)(4)s.

- Part III: Proxy tax if over limits.

For 2025, track all expenditures carefully. A voter education nonprofit reports getting out the vote drives here. Stay within the rules to keep exempt status.

IRS Form 990 Schedule C: Supplemental Financial Statements

IRS Form 990 Schedule D handles complex finances. It’s for groups with trusts, endowments, or restricted funds.

- Part I: Organizations maintaining donor-advised funds.

- Part III: Collections of art or history items.

- Part V: Escrow accounts or conservation easements.

- Part XI: Reconciliation of assets.

A university with endowments uses this to show long-term holdings. It adds depth to your report.

IRS Form 990 Schedule G: Fundraising and Gaming

For events like auctions, IRS Form 990 Schedule G details them.

- Part I: Gaming bingo or lotteries, report gross proceeds.

- Part II: Contributions from solicitations.

- Part III: Noncash contributions over $500.

In 2025, value prizes accurately. A theatre’s gala reports ticket sales minus costs. This ensures proper deductions.

IRS Form 990 Schedule O: Supplemental Information

IRS Form 990 Schedule O is your space for stories. Explain anything unclear.

- Attach to questions in Parts III, V, VI, etc.

- Describe policy changes or unusual events.

- Keep it factual and concise.

For instance, explain a board conflict resolution. Everyone might need this for clarity.

IRS Form 990 Schedule J: Compensation Reporting

IRS Form 990 Schedule J lists pay for leaders. It’s key for transparency.

- Part I: Base pay, bonuses for officers and key staff.

- Part II: Benefits like health insurance.

- Report over $150,000 total.

For 2025, include related organisation pay. A CEO’s salary at a health clinic goes here. Donors, check this.

IRS Form 990 Schedule R: Related Organizations

If you have affiliates, IRS Form 990 Schedule R connects them.

- Part I: List controlled entities or partnerships.

- Part V: Transactions over $50,000, like loans.

- Part VI: Disregarded entities.

A national group with local chapters reports shared services. It shows the full picture.

Common Form 990 Filing Mistakes to Avoid

Errors happen, but fix them early. Common ones:

- Forgetting schedules, double-check Part IV.

- Wrong support calculations in Schedule A.

- Incomplete compensation in Part VII.

- Missing e-filing.

Consult AcctRight PLLC for help. Review with your board before submitting. Accuracy saves time.

Tips for IRS Form 990 Compliance

Stay on track with these steps from the IRS Form 990 compliance guide:

- Track your finances monthly to ensure accurate reporting.

- Keep bylaws and governance documents up-to-date.

- Train staff on record-keeping and documentation.

- Leverage IRS resources like StayExempt tutorials for ongoing compliance.

- Review filings with your board before submission.

Donors/public stakeholders value this. A clean filing boosts credibility.

How AcctRight PLLC Supports Nonprofits

At AcctRight PLLC, we provide specialised accounting and tax services for nonprofits:

- Determine the correct Form 990 variant

- Prepare and review all schedules accurately

- Ensure full compliance with IRS rules

- Assist with electronic filing

- Offer expert guidance on tax planning and reporting

With us, your nonprofit can focus on its mission, knowing professionals handle filings.

Conclusion:

Following IRS Form 990 instructions for 2025 ensures your nonprofit stays compliant, transparent, and credible. From picking the right form to completing schedules and filing electronically, every step matters. AcctRight PLLC offers expert guidance for nonprofits, from selecting the right form to completing schedules accurately and filing on time. With our help, your organisation can maintain compliance, reduce risk, and dedicate more resources to achieving your mission.

Contact AcctRight PLLC today to simplify your Form 990 process, avoid errors, and ensure your nonprofit remains fully compliant with IRS regulations.

Frequently Asked Questions

Do all nonprofits need to file Form 990?

Most nonprofits must file annually, but small organizations may qualify for the 990-N e-Postcard.

What happens if a nonprofit fails to file?

Noncompliance can result in fines, loss of tax-exempt status, and reputational damage.

What is the difference between Form 990, 990-EZ, and 990-PF?

- 990: Standard form for large nonprofits

- 990-EZ: Simplified for small nonprofits

- 990-PF: For private foundations reporting charitable distributions

Which schedules are mandatory?

Schedules vary by organization type. Common schedules include A, B, G, J, and R.

Can AcctRight PLLC assist with electronic filing?

Yes, we help nonprofits e-file Form 990 accurately and efficiently.

What is the difference between IRS Form 990 and 990-EZ?

Form 990 is the full version used by nonprofits with over $200,000 in receipts or $500,000 in assets. Form 990-EZ is a shorter version for mid-sized organizations below these thresholds.