For leaders of tax-exempt organizations, the annual filing deadline is important to avoid penalties. The Internal Revenue Service (IRS) mandates that most nonprofits file an information return, such as Form 990, to maintain their good standing. What happens when more time is needed to compile accurate financial data? This is where IRS Form 8868, the Application for Automatic Extension of Time To File an Exempt Organization Return, becomes an essential tool. Properly understanding and following the instructions for Form 8868 is not merely administrative.

This guide will walk you through every side of the form, from eligibility to submission, providing the clarity and confidence needed to manage this process effectively.

What is IRS Form 8868?

Form 8868, officially titled “Application for Automatic Extension of Time To File an Exempt Organization Return,” allows tax-exempt organizations to request additional time to file their annual information returns. The IRS.gov (Rev. January 2026) expanded coverage to include governmental entities filing Form 990-T, a change that affects state and local organizations significantly. As reported by Yahoo Finance in May 2025, missing this update could result in invalid extensions for governmental filers. The purpose of Form 8868 extends beyond simple deadline management.

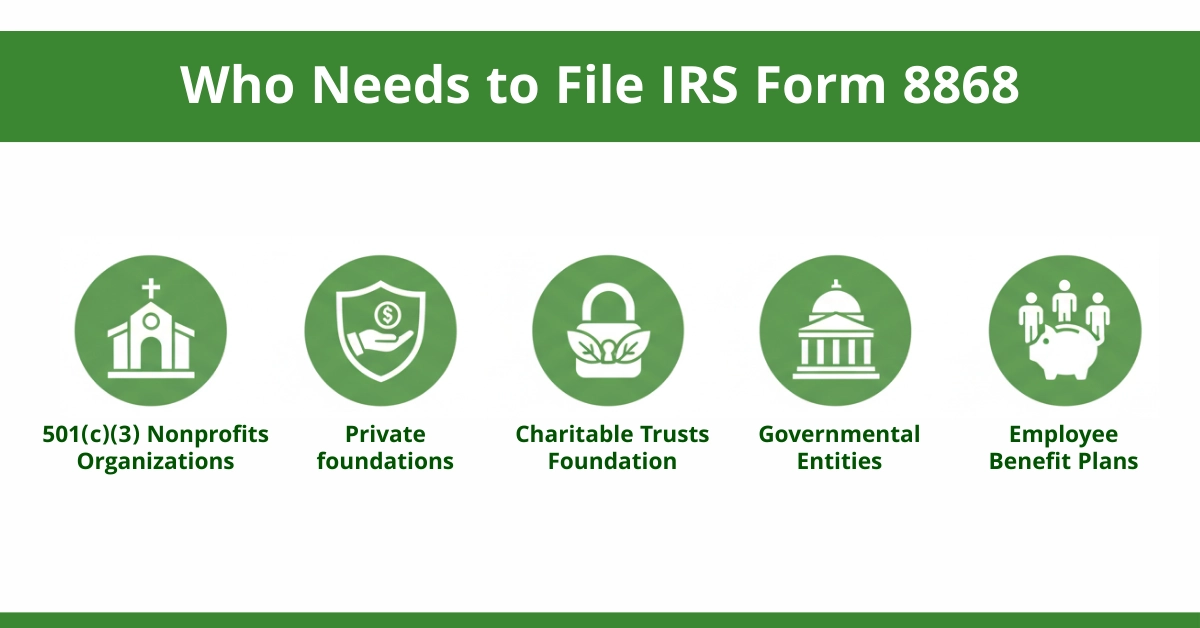

Who Needs to File Form 8868

According to IRS.gov, you need Form 8868 if you manage:

- 501(c)(3) nonprofits and other tax-exempt organizations

- Private foundations filing Form 990-PF

- Charitable trusts requiring Form 1041-A or Form 5227

- Governmental entities filing Form 990-T with elective payment elections

- Employee benefit plans filing Form 5330 for excise taxes

Critical distinction: For-profit corporations and partnerships must use Form 7004, not Form 8868. This common confusion causes automatic rejections.

Understanding Automatic vs. Additional Extensions

Understanding the difference between extension types solves the confusion many nonprofits face about eligibility.

1. Automatic 6-Month Extension (Part II)

This is your organization’s first line of defense. The IRS grants this automatically if you:

- File Form 8868 by the original due date

- Complete all required fields accurately

- Pay any estimated tax due with the application

2. Additional Extension (Not Available for Form 8868)

Unlike Form 7004 for businesses, Form 8868 does not allow additional extensions beyond six months. If your organization needs more than six months, you must submit a private letter request showing “reasonable cause”, a difficult standard to meet.

Extension periods by organization type:

- Form 990/990-EZ filers: May 15 → November 15 (calendar year)

- Form 990-PF private foundations: May 15 → November 15

- Form 990-T trusts/corporations: 15th day of 5th month → 15th day of 11th month

- Form 5330 employee benefit plans: Varies by plan year, up to 6 months maximum

Filing Deadlines to Remember:

- May 15, 2026: Calendar year Form 990/990-EZ/990-PF due

- November 15, 2026: Extended deadline if Form 8868 filed by May 15

- Form 5330: Due by the last day of the 7th month after the plan year ends

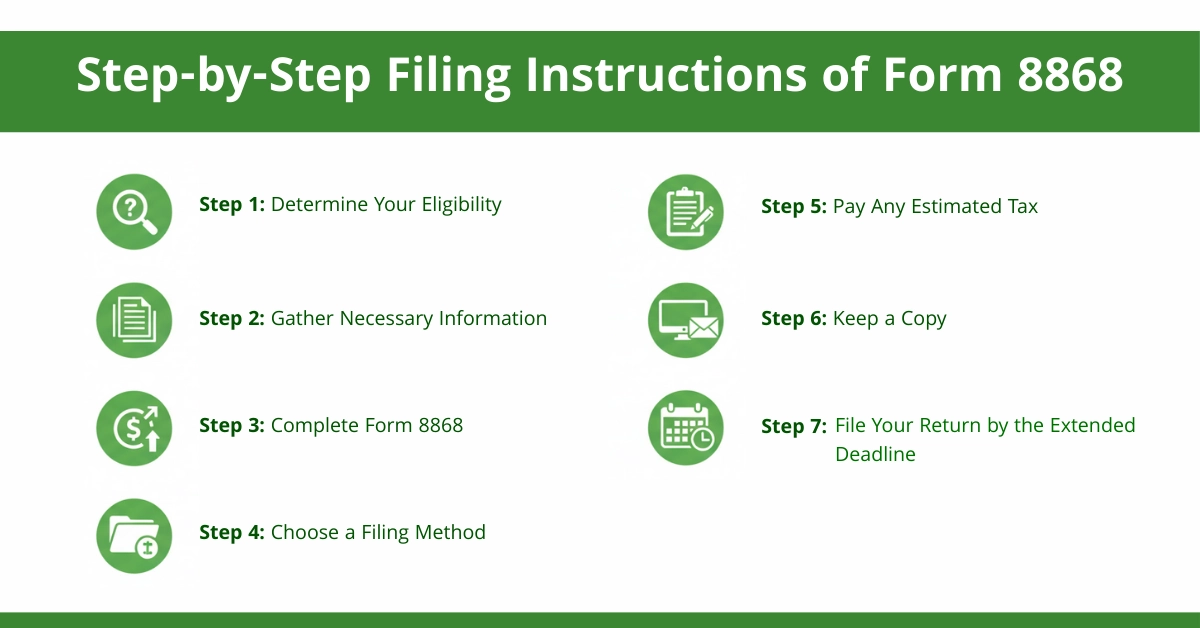

Step-by-Step Filing Instructions for Form 8868

Form 8868 is used by tax-exempt organizations to request an extension of time to file certain IRS returns, such as Form 990, 990-EZ, or 990-PF. Filing this form helps you avoid late-filing penalties if you need more time.

Step 1: Determine Your Eligibility

Before filing, make sure your organization qualifies for an extension:

- Must be a tax-exempt organization required to file Form 990, 990-EZ, or 990-PF.

- Extensions are typically 6 months for most returns (longer for some returns).

Step 2: Gather Necessary Information

You’ll need:

- Organization’s name and address

- Employer Identification Number (EIN)

- Return type (Form 990, 990-EZ, or 990-PF)

- Tax year for which the extension is requested

- Estimated tax due (if any)

Step 3: Complete Form 8868

Form 8868 has two main parts:

Part I – Automatic 6-Month Extension

- Line 1: Enter organization name and EIN

- Line 2: Check the box for the type of return you are filing

- Line 3: Enter the tax year ending date

- Line 4: Estimate any tax due and include payment if required

- Line 5a: Sign and date (if submitting a paper form)

Note: Most nonprofits can get an automatic 6-month extension without explaining the reason.

Part II – Additional Extension (if needed)

- Only required if you are requesting additional time beyond the automatic 6 months.

- Include a reasonable cause explanation.

- The IRS must approve this extension; it is not automatic.

Step 4: Choose a Filing Method

Form 8868 can be filed electronically or by mail.

Electronic Filing (Recommended)

- Use IRS-approved e-file software or the Modernized e-File (MeF) system.

- Electronically filing is faster and ensures your extension is recorded immediately.

Paper Filing

- Mail the completed form to the appropriate IRS address listed in the Form 8868 instructions.

- Make sure it’s postmarked by the original return due date to avoid penalties.

Step 5: Pay Any Estimated Tax

- While Form 8868 extends filing time, it does not extend payment time.

- Pay any tax due by the original due date to avoid interest or penalties.

Step 6: Keep a Copy

- Save a copy of Form 8868 and proof of submission.

- If filed electronically, save the confirmation notice.

Step 7: File Your Return by the Extended Deadline

- Once your extension is approved, the new filing deadline is typically 6 months from the original due date.

- Ensure your organization files Form 990, 990-EZ, or 990-PF on or before the extended deadline.

Payment and Mailing Instructions for 8868 IRS Form

Payment Instructions

Remember, the extension doesn’t cover payment taxes that are due by the original date. Calculate estimates based on your return’s instructions; for Form 990-PF, this includes excise taxes.

Options include electronic funds transfer via EFTPS (preferred for accuracy) or checks payable to the United States Treasury. In 2026, the IRS continues to push for digital methods to minimize errors, as updated in their guidelines. If you’re a healthcare provider or real estate professional with complex investments, our tailored tax strategies at Acct. Right, PLLC can help optimize these payments.

| Payment Method | Pros | Cons |

| EFTPS | Secure, fast confirmation | Requires setup |

| Check/Money Order | Simple for small amounts | Mailing delays |

| Electronic Funds Withdrawal | Convenient during e-filing | Bank details needed |

Mailing Instructions

If you are filing Form 8868 on paper, send it to the appropriate IRS address based on your location. For most organizations, this is:

- Internal Revenue Service

- Mail Stop 6054

- 1973 N Rulon White Blvd.

- Ogden, UT 84201-0045

Always use certified mail for proof of timely filing, especially if deadlines fall on weekends.

Common Mistakes to Avoid Penalties

Avoid these common errors that can cause delays or rejections:

- Incorrect or missing EIN: Always double-check your EIN and organizational details.

- Failure to pay taxes on time: Payments must be made by the original due date to avoid penalties.

- Missing signatures on Form 5330: Ensure that the necessary signatures are included for specific filings.

- Filing with the wrong IRS office: Use the correct address to avoid processing delays.

By consulting experts like Acct. Right, PLLC, your organization can reduce the risk of these mistakes and ensure a smooth filing process.

Conclusion

Mastering the instructions Form 8868 ensures your organization stays compliant without unnecessary stress. By gathering info early, filing accurately, and paying on time, you protect your status and resources. For complete peace of mind, consult experts who understand your industry. At Acct. Right, PLLC, our commitment to tailored solutions, like tax preparation and financial modeling, helps you navigate these requirements effectively.

Ready to simplify your filings? Reach out today.

Frequently Asked Questions

What is Form 8868 and who needs it?

Form 8868 is used by tax-exempt organizations to request an extension for filing IRS returns like Form 990.

How do I file Form 8868 for a nonprofit organization?

To file Form 8868, complete it with your organization’s name, EIN, and the appropriate tax return details, then submit it to the IRS.

Can Form 8868 be filed electronically?

Yes. Form 8868 can be filed electronically through the IRS Modernized e-File (MeF) system for quicker processing.

Where do I mail Form 8868 if filing by paper?

Form 8868 should be mailed to the correct IRS address based on your location; refer to the IRS website for the appropriate mailing address.

How do I calculate payments for Form 8868?

Calculate estimated payments based on your prior year’s tax, then ensure the correct amount is included with your filing.

Disclaimer:

This post is for informational purposes only and not tax or legal advice. Please consult us for personalized tax and accounting solutions. Some images are AI-generated for illustration.